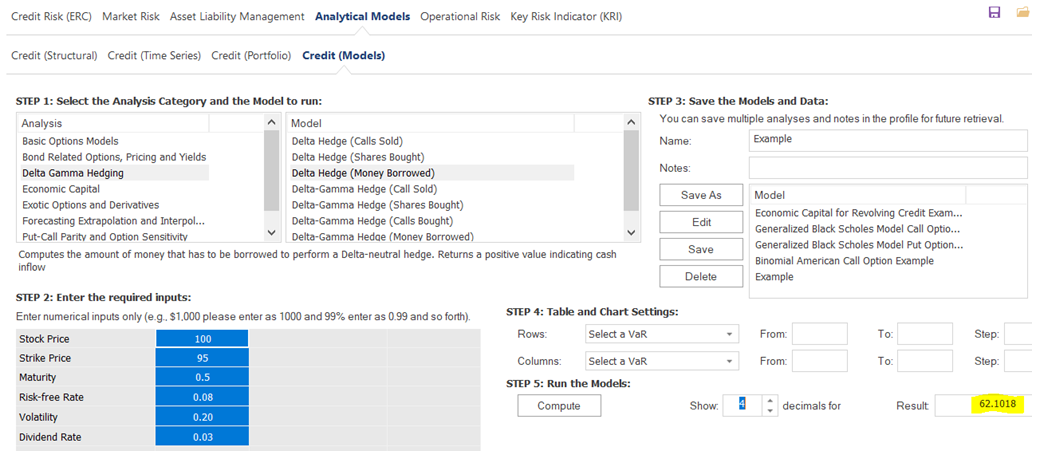

File Name: Risk Analysis – Delta Hedge

Location: Modeling Toolkit | Risk Analysis | Delta Hedge

Brief Description: Sets up a delta riskless and costless hedge in determining the number of call options to sell, number of common stocks to buy, and the borrowing amount required to set up a costless hedge

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTDeltaHedgeCallSold, MTDeltaHedgeSharesBought, MTDeltaHedgeMoneyBorrowed

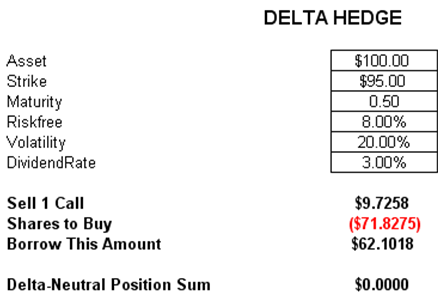

The Delta hedge (Figure 2.23) provides a hedge against small changes in the asset value by buying some equity shares of the asset and financing it through selling a call option and borrowing some money. The net should be a zero-sum game to provide a hedge where the portfolio’s delta is zero. For instance, an investor computes the portfolio delta of some underlying asset and offsets this delta through buying or selling some additional instruments such that the new instruments will offset the delta of the existing underlying assets. Typically, say an investor holds some stocks or commodities like gold in the long position, creating a positive delta for the asset. To offset this, he or she sells some calls to generate a negative delta, such that the amount of the call options sold on the gold is sufficient to offset the delta in the portfolio.

Figure 2.23: Delta Hedging