File Name: Risk Analysis – Portfolio Risk and Return Profile

Location: Modeling Toolkit | Risk Analysis | Portfolio Risk and Return Profile

Brief Description: Computes the risk and return on a portfolio of multiple assets given each asset’s own risk and return as well as its respective pairwise covariance

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTPortfolioReturns, MTPortfolioVariance, MTPortfolioRisk

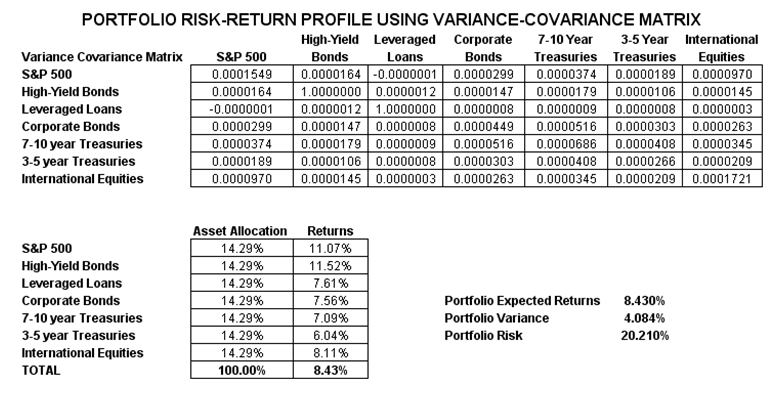

As illustrated in Figure 123.1, this model computes the portfolio level of returns and risks given the percent allocated on various assets, the expected returns and risks on individual assets, and the variance-covariance matrix of the asset mix (you can use the Variance-Covariance tool in the Modeling Toolkit to compute this matrix if you have the raw stock returns data).

Figure 123.1: Portfolio risk-return profile

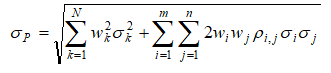

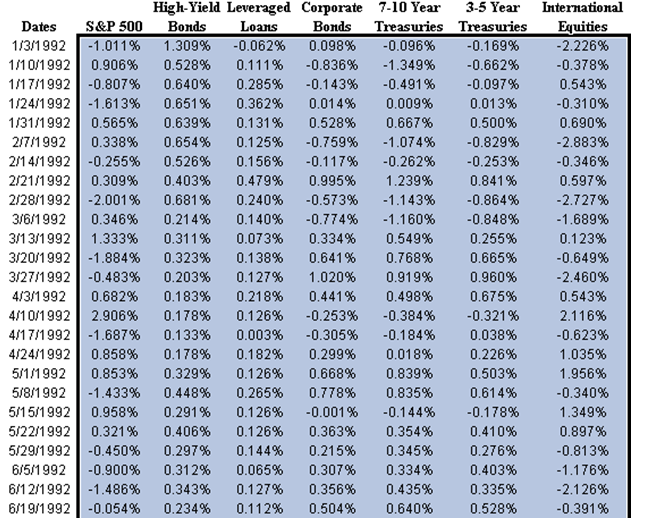

For instance, if raw data on various assets exist (Figure 123.2), simply select the data area and run the Variance-Covariance tool under the Modeling Toolkit | Tools menu item. The generated results are shown in the computed Variance-Covariance worksheet. This is a very handy tool indeed as the portfolio risk computations can sometimes be rather cumbersome. Consider that the portfolio risk (computed as volatility) is:

where the volatility of each asset k is squared and multiplied by its weight squared, summed, and added to the summation of all pairwise correlations among the assets (ρ), by their respective weights (w) and volatilities (σ). For the example model, this equation expands to 21 cross terms and 7 squared terms, creating a relatively complicated equation to compute manually. Using the single MTPortfolioRisk equation, the process is greatly simplified.

Figure 123.2: Raw stock returns data