File Name: Credit Analysis – Credit Default Swaps and Credit Spread Options

Location: Modeling Toolkit | Credit Analysis | Credit Default Swaps and Credit Spread Options

Brief Description: Examines the basics of credit derivatives

Requirements: Modeling Toolkit, Risk Simulator

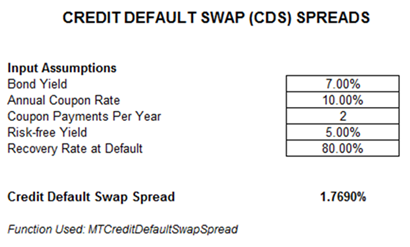

A credit default swap (CDS) allows the holder of the instrument to sell a bond or debt at par value when a credit event or default occurs. This model computes the valuation of the CDS spread (Figure 11.1). A CDS does not protect against movements of the credit spread (only a credit spread option can do that), but only protects against defaults. Typically, to hedge against defaults and spread movements, both CDS and credit spread options (CSO) are used. This CDS model assumes a no-arbitrage argument, and the holder of the CDS makes periodic payments to the seller (similar to a periodic insurance premium) until the maturity of the CDS or until a credit event or default occurs. Because the notional amount to be received in the event of a default is the same as the par value of the bond or debt, and time value of money is used to determine the bond yield, this model does not require these two variables as input assumptions.

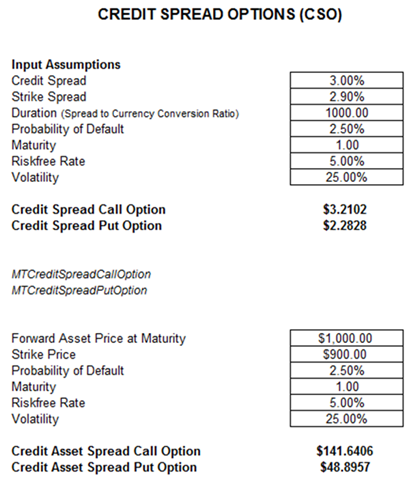

In contrast, CSOs are another type of exotic debt option where the payoff depends on a credit spread or the price of the underlying asset that is sensitive to interest rate movements such as floating or inverse floating rate notes and debt. A CSO call option provides a return to the holder if the prevailing reference credit spread exceeds the predetermined strike rate, and the duration input variable is used to translate the percentage spread into a notional currency amount. The CSO expires when there is a credit default event. Again, note that a CSO can only protect against any movements in the reference spread and not a default event (only a CDS can do that). Typically, to hedge against both defaults and spread movements, CDS and CSO are used together. In some cases, when the CSO covers a reference entity’s underlying asset value and not the spread itself, the credit asset spread options are used instead (Figure 11.1).

Figure 11.1: Credit default swaps and credit spread options