For market risk, as a Pillar I risk, the requirements are similar to those for economic regulatory capital. The particularities of market risk make it, possibly, the one that is easier to model and calculate, and the one that has had more tool development so far. This is explained by the fact that the main input for market risk measurement and modeling is market prices of assets or, more practically, their volatilities. Therefore, there is great public availability of data, as opposed to the other Pillar I risks that do not have daily prices publicly available. As an example, there is no public pricing of a particular group of retail loans issued by a private bank. Yet, modeling tools for both market and credit risk are based on the same approach: utilizing past stylized data to project future behavior under certain assumptions and within a confidence interval. Logically then, market risk has a great bundle of information available and the potential to better test and calibrate models. As presented, market risk models take on a Value at Risk (VAR) approach.

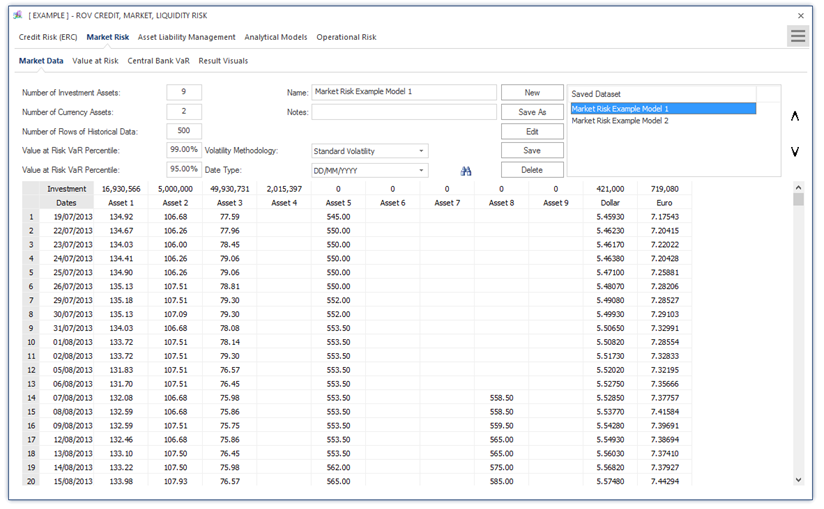

Figure 1.3 illustrates the PEAT utility’s ALM-CMOL module for Market Risk where Market Data is entered. Users start by entering the global settings, such as the number of investment assets and currency assets the bank has in its portfolio, that require further analysis; the total number of historical data that will be used for analysis; and various VaR percentiles to run (e.g., 99.00% and 95.00%). In addition, the volatility method of choice (industry standard volatility or Risk Metrics volatility methods) and the date type (mm/dd/yyyy or dd/mm/yyyy) are entered. The amount invested (balance) of each asset and currency is entered and the historical data can be entered, copied and pasted from another data source, or uploaded to the data grid, and the settings as well as the historical data entered can be saved for future retrieval and further analysis in subsequent subtabs.

Figure 1.3: Market Risk Data

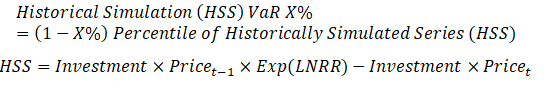

Figure 1.4 illustrates the computed results for the Market VaR. Based on the data entered in the interface shown in Figure 1.3, the results are computed and presented in two separate grids: the VaR results and asset positions and details. The computations can be triggered to be rerun or Updated, and the results can be exported to an Excel report template if required. The results computed in the first grid are based on user input market data.

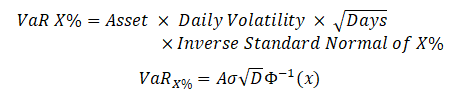

For instance, the VaR calculations are simply the Asset Position × Daily Volatility × Inverse Standard Normal Distribution of VaR Percentile × Square Root of the Horizon in Days.

In other words, we have:

Therefore, the Gross VaR is simply the summation of all VaR values for all assets and foreign exchange–denominated assets. In comparison, the Internal Historical Simulation VaR uses the same calculation based on the historically simulated time-series of asset values. The historically simulated time-series of asset values is obtained by the Asset’s Investment × Asset Pricet-1 × Period-Specific Relative Returns – Asset’s Current Position. The Asset’s Current Position is simply the Investment × Asset Pricet. From this simulated time series of asset flows, the (1 – X%) percentile asset value is the VaR X%. Typically, X% is 99.00% or 95.00% and can be changed as required by the user based on the regional or country-specific regulatory agency’s statutes.

This can be stated as:

Figure 1.4: Market Value at Risk

Many countries issue regulations for market risk measurement and capital allocation, whereby some standardized models are suggested or even imposed in line with the Basel Standards. We analyze such an example in Figure 1.5, where the regulatory model can be obtained by utilizing the parameters given by the regulator (i.e., volatilities and holding periods for given common assets). The structure of the tool allows for the comparison of regulatory, internal, and stressed scenarios, giving the analysts a large array of results to better interpret risk measurement, capital allocation, and future projections.