File Name: Exotic Options – Asian Geometric

Location: Modeling Toolkit | Exotic Options | Asian Geometric

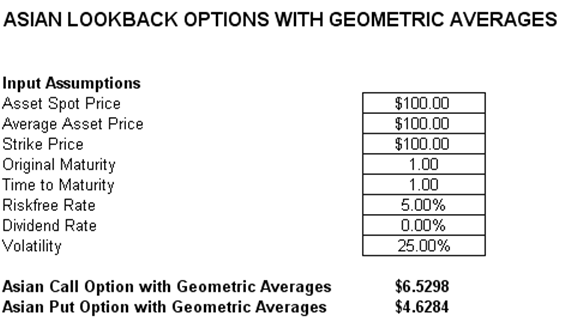

Brief Description: Solves an Asian lookback option using closed-form models, where the lookback is linked to the geometric average of past prices

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTAsianCallwithGeometricAverageRate, MTAsianPutwithGeometricAverageRate

Asian options (also called Average Options) are options whose payoffs are linked to the average value of the underlying asset on a specific set of dates during the life of the option. An average rate option is a cash-settled option whose payoff is based on the difference between the average value of the underlying during the life of the option and a fixed strike. The Geometric version means that the prices are geometric averages rather than simple arithmetic averages, providing a more conservative measure (Figure 36.1).

End-users of currency, commodities, or energy trading tend to be exposed to average prices over time, so Asian options are attractive for them. Asian options are also popular with corporations and banks with ongoing currency exposures. These Asian options are attractive because they tend to be less expensive—sell at lower premiums—than comparable vanilla puts or calls. This is because the volatility in the average value of an underlying stock or asset tends to be lower than the volatility of the actual values of the underlying stock or asset. Also, in situations where the underlying asset is thinly traded or there is the potential for its price to be manipulated, an Asian option offers some protection. It is more difficult to manipulate the average value of an underlying asset over an extended period of time than it is to manipulate it just at the expiration of an option.

Figure 36.1: Computing the Asian lookback option (geometric average)