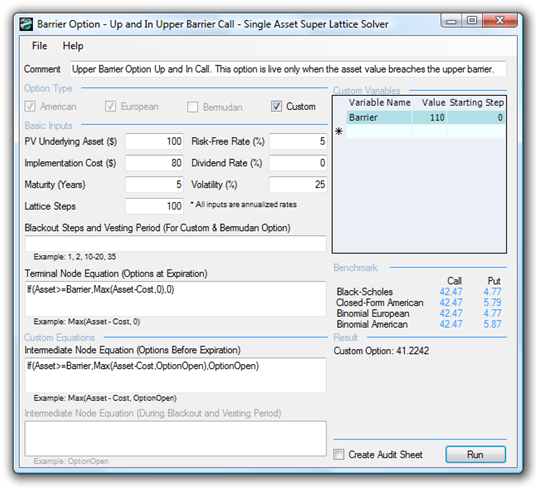

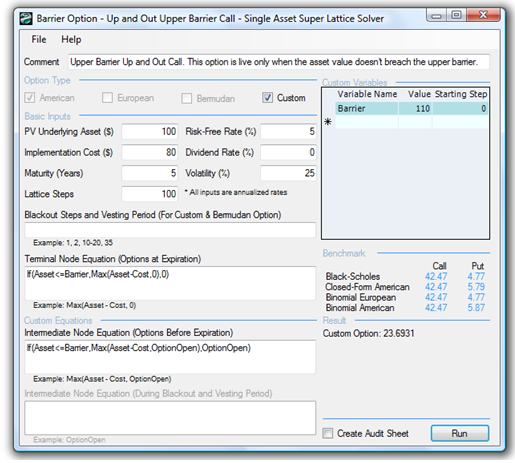

File Names: Exotic Options – Barrier Option – Up and In Upper Barrier Call; Real Options – Barrier Option – Up and Out Upper Barrier Call

Location: Modeling Toolkit | Real Options

Brief Description: Computes upper barrier options, that is, options that either get kicked in the money or out of the money when they breach an upper barrier

Requirements: Modeling Toolkit, Real Options SLS

The Upper Barrier Option measures the strategic value of an option (this applies to both calls and puts) that comes either in the money or out of the money when the Asset Value hits an artificial Upper Barrier that is currently higher than the asset value. Therefore, in an Up and In option (for both calls and puts), the option becomes live if the asset value hits the upper barrier. Conversely, for the Up and Out option, the option is live only when the upper barrier is not breached. This is very similar to the Lower Barrier Option but now the barrier is above the starting asset value, and for a binding barrier option, the implementation cost is typically lower than the upper barrier. That is, the upper barrier is usually greater than implementation cost and the upper barrier is also greater than starting asset value.

Examples of this option include contractual agreements whereby if the upper barrier is breached some event or clause is triggered. The values of barrier options typically are lower than standard options, as the barrier option will have value within a smaller price range than the standard option. The holder of a barrier option loses some of the traditional option value; therefore, a barrier option should sell at a lower price than a standard option. An example would be a contractual agreement whereby the writer of the contract can get into or out of certain obligations if the asset or project value breaches a barrier.

The Up and In Upper American Barrier Option has a slightly lower value than a regular American call option, as seen in Figure 176.1, because some of the option value is lost when the asset is less than the barrier but greater than the implementation cost. Clearly, the higher the upper barrier, the lower the up and in barrier option value will be as more of the option value is lost due to the inability to execute when the asset value is below the barrier (example file used: Barrier Option – Up and In Upper Barrier Call). For instance:

- When the upper barrier is $110, the option value is $41.22.

- When the upper barrier is $120, the option value is $39.89.

In contrast, an Up and Out Upper American Barrier Option is worth a lot less because this barrier truncates the option’s upside potential. Figure 176.2 shows the computation of such an option. Clearly, the higher the upper barrier, the higher the option value will be (example file used: Barrier Option – Up and Out Upper Barrier Call). For instance:

- When the upper barrier is $110, the option value is $23.69.

- When the upper barrier is $120, the option value is $29.59.

Finally, note the issues of nonbinding barrier options. Examples of nonbinding options are:

- Up and Out Upper Barrier Calls, where the option will be worthless when the Upper Barrier ≤ Implementation Cost

- Up and In Upper Barrier Calls, where the option value reverts to a simple call option when Upper Barrier ≤ Implementation Cost

Upper Barrier Options are contractual options; typical examples are:

- A manufacturer contractually agrees not to sell its products at prices higher than a prespecified upper barrier price level.

- A client agrees to pay the market price of a good or product until a certain amount and then the contract becomes void if it exceeds some price ceiling.

Figures 176.1 and 176.2 illustrate American Barrier Options. To change these into European Barrier Options, set the Intermediate Node Equation to Option Open. In addition, for certain types of contractual options, vesting and blackout periods can be imposed. For solving such Bermudan Barrier Options, keep the same Intermediate Node Equation as the American Barrier Options but set the Intermediate Node Equation During Blackout and Vesting Periods to Option Open and insert the corresponding blackout and vesting period lattice steps. Finally, if the barrier is a changing target over time, put in several custom variables named Barrier with the different values and starting lattice steps.

Figure 176.1: Up and in upper American barrier option

Figure 176.2: Up and out upper American barrier option