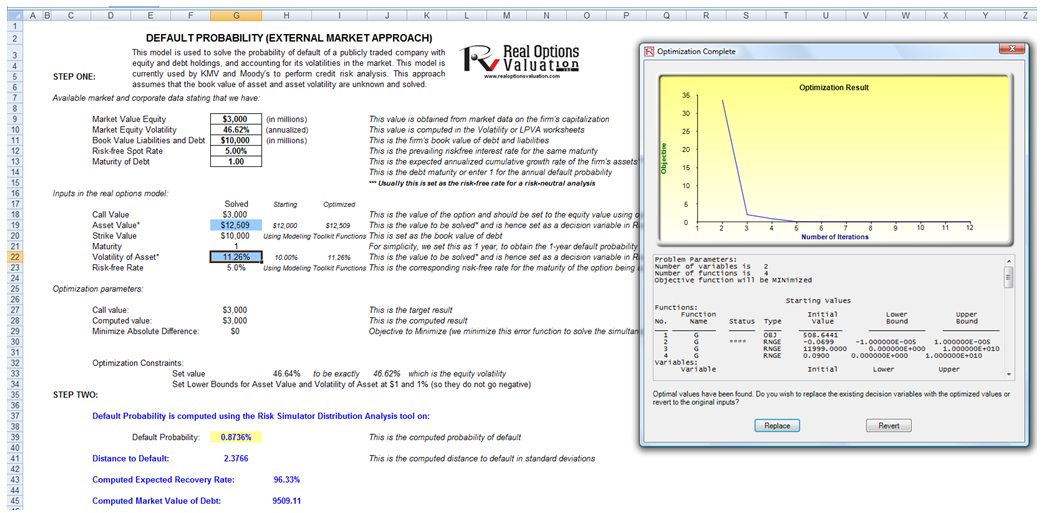

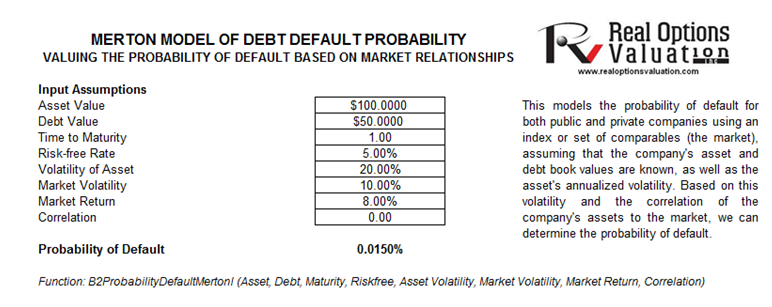

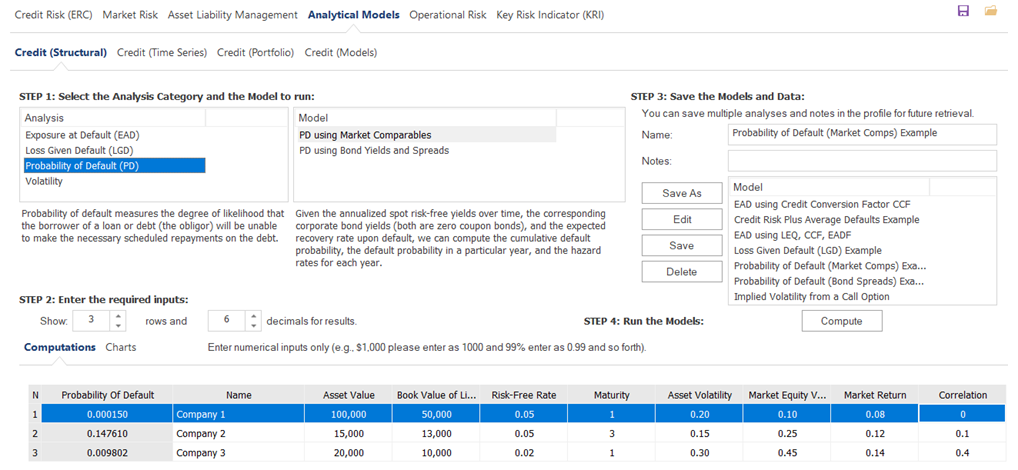

In addition, several other structural models exist for computing the probability of default of a firm. Specific models are used depending on the need and availability of data. In the previous example, the firm is a publicly-traded firm, with stock prices and equity volatility that can be readily obtained from the market. In this next example, we assume that the firm is privately held, meaning that there would be no market equity data available. It essentially computes the probability of default or the point of default for the company when its liabilities exceed its assets, given the asset’s growth rates and volatility over time (Figure 2.3). It is recommended that before using this model, the previous model on external publicly traded companies is first reviewed. Similar methodological parallels exist between these two models, whereby this example builds upon the knowledge and expertise of the previous example. In Figure 2.3, the example firm with an asset value of $12M and a book value of debt at $10M with significant growth rates of its internal assets and low volatility returns a 0.67% probability of default. In addition, instead of relying on the valuation of the firm, external market benchmarks can be used if such data are available. In Figure 2.4, we see that additional input assumptions such as the market fluctuation (market returns and volatility) and relationship (correlation between the market benchmark and the company’s assets) are required. The model used is the Probability of Default – Merton Market Options Model accessible from Modeling Toolkit | Prob of Default | Merton Market Options Model (Industry Comparable).

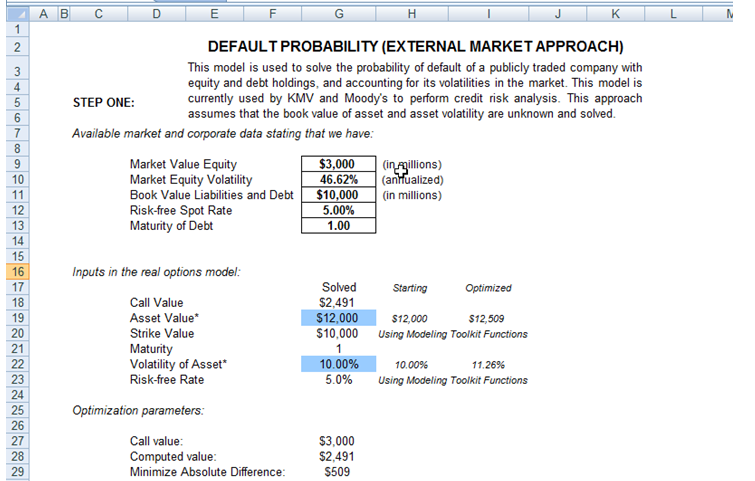

Figure 2.1: Probability of Default Model for External Public Firms

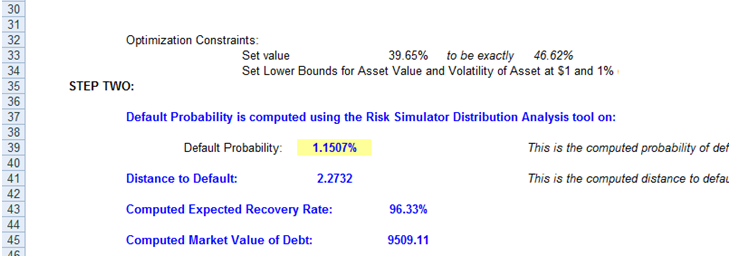

Figure 2.2: Optimized Model Results Showing Probability of Default

Figure 2.3: Probability of Default of a Privately Held Company

Figure 2.4: Default Probability of a Privately Held Entity Calibrated to Market Fluctuations