The NPV method assumes that the project cash flows are reinvested at the cost of capital, whereas the IRR method assumes project cash flows are reinvested at the project’s own IRR. The reinvestment rate at the cost of capital is the more correct approach in that this is the firm’s opportunity cost of money (if funds were not available, then capital is raised at this cost).

The modified internal rate of return (MIRR) method is intended to overcome two IRR shortcomings by setting the cash flows to be reinvested at the cost of capital and not its own IRR, as well as preventing the occurrence of multiple IRRs, because only a single MIRR will exist for all cash flow scenarios. Also, NPV and MIRR will usually result in the same project selection when projects are of equal size (significant scale differences might still result in a conflict between MIRR and NPV ranking).

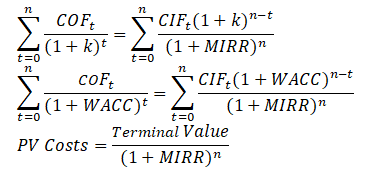

The MIRR is the discount rate that forces the present value of costs of cash outflows (COF) to be equal to the present value of the terminal value (the future value of cash inflows, or CIF, compounded at the project’s cost of capital, k).