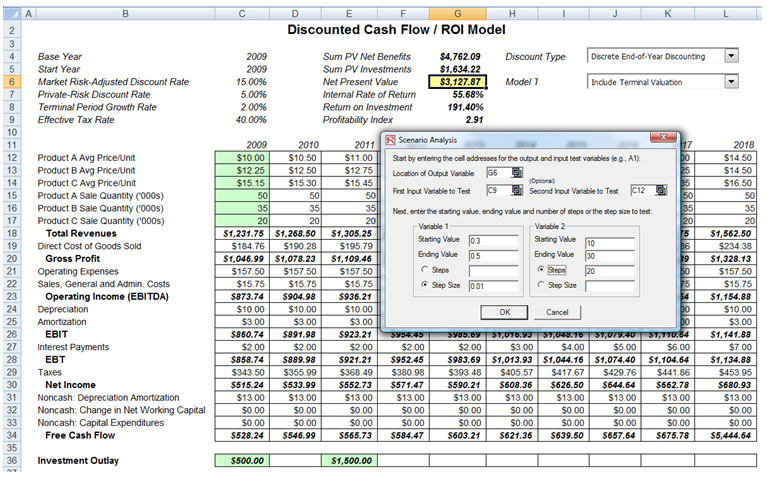

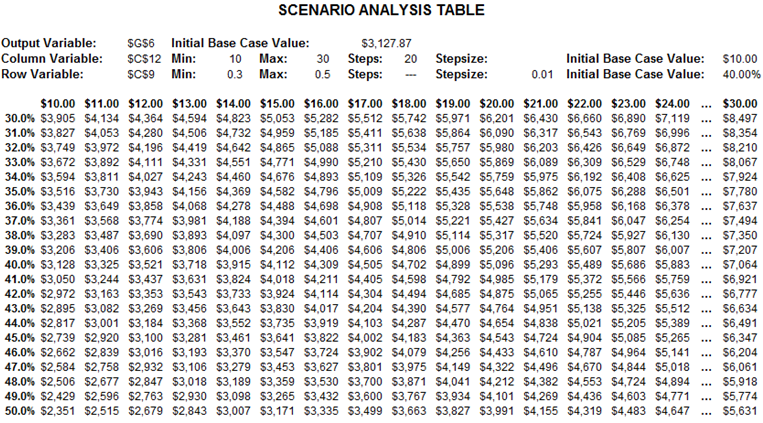

The scenario analysis tool in Risk Simulator allows you to run multiple scenarios quickly and effortlessly by changing one or two input parameters to determine the output of a variable. Figure 15.24 illustrates how this tool works on the discounted cash flow sample model (Risk Simulator | Example Models | 07 DCF, ROI, and Volatility). In this example, cell G6 (net present value) is selected as the output of interest, whereas cells C9 (effective tax rate) and C12 (product price) are selected as inputs to perturb. You can set the starting and ending values to test as well as the step size or the number of steps to run between these starting and ending values. The result is a scenario analysis table (Figure 15.25), where the row and column headers are the two input variables and the body of the table shows the net present values. This scenario analysis tool is available via Risk Simulator | Analytical Tools | Scenario Analysis.

Figure 15.24: Scenario Analysis Tool

Figure 15.25: Scenario Analysis Table