File Name: Exotic Options – European Call Option with Dividends

Location: Modeling Toolkit | Real Options Models | European Call Option with Dividends

Brief Description: Uses the customized binomial lattice approach to solve a European call option with dividends, where the holder of the option can exercise only at maturity and not before

Requirements: Modeling Toolkit, Real Options SLS

A European call option allows the holder to exercise the option only at maturity. An American option can be exercised at any time before as well as up to and including maturity. A Bermudan option is like an American and European option mixed––at certain vesting and blackout periods, the option cannot be executed until the end of the blackout period, when it then becomes exercisable at any time until its maturity. In a simple plain vanilla call option, all three varieties have the same value, as it is never optimal to exercise early, making all three options revert to the value of a simple European option. However, this does not hold true when dividends exist. When dividends are high enough, it is typically optimal to exercise a call option early, particularly before the ex-dividend date hits, reducing the value of the asset and, consequently, the value of the call option. The American call option typically is worth more than a Bermudan option, which is typically worth more than a European option, except in the special case of a simple plain vanilla call option.

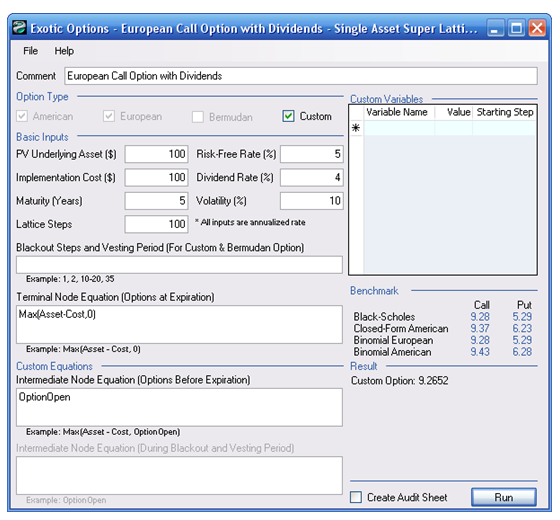

Figure 46.1 illustrates how a simple European call option with dividends can be modeled using the binomial lattice with 100 steps. The terminal equation is simply set as Max (Asset – Cost, 0) indicative of the ability to execute the option at the terminal nodes at maturity if it is in the money or expires worthless otherwise. The intermediate equation is set as Option Open, which indicates that at any time before expiration, the only thing the owner can do is to keep the option open and wait until maturity to decide if the option should be executed. You can refer to Part II in this book on using the Real Options SLS software for more details on using the software in more sophisticated and customized options with changing inputs and real options applications.

Figure 46.1: European call option with dividends (SLS and customized equations)