File Name: Credit Analysis – Credit Risk and Effects on Prices

Location: Modeling Toolkit | Credit Analysis | Credit Risk and Effects on Prices

Brief Description: Values the effects of credit spreads as applied to bond and debt prices

Requirements: Modeling Toolkit, Risk Simulator

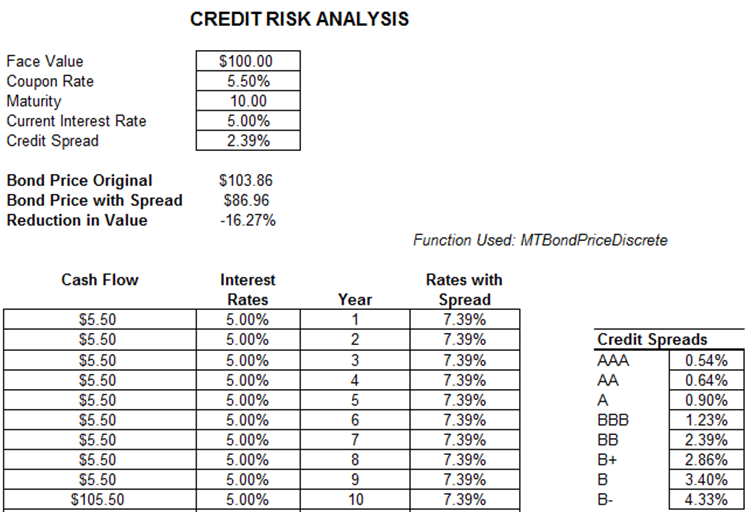

Banks selling or issuing fixed income products and vehicles or issuing debt and credit lines need to understand the effects of interest rate risks. This model is used to analyze the effects of a credit spread as applied to the price of a bond or debt. The worse the credit rating, the higher the required credit spread and the lower the market value of the bond or debt. That is, the lower the credit rating of a debt issue, the higher the probability of default, and the higher the risk to the debt holder. This means that the debt holder will require a higher rate of return or yield on the debt in remuneration of this higher risk level. This additional yield is termed the credit spread (the additional interest rate above and beyond a similar debt issue with no default risk). Using a higher yield, the price of the debt is obtained through summing the present values of future coupon payments and principal repayment cash flows, and the higher the yield, the lower the value of the bond or debt. So, risk reduces the value of the bond, which means that assuming the bond does not default, the yield to maturity on the bond is higher for a risky bond than a zero-risk bond (i.e., with the same cash flows in the future, the cheaper the bond, the higher the yield on the bond, holding everything else constant). This model also allows you to determine the effects on the price of debt of a change in credit rating (see Figure 12.1).

The question now is, why do we analyze credit risk based on the bond market as an example? Bonds are, by financial definitions, the same as debt. A bond is issued by a corporation or some government agency (debt is obtained by individuals or companies in need of external funding, that is, a bank provides a loan or credit line to these individuals or corporations). The issuer receives a discounted portion of the face value up front (for debt, the obligor receives the funds up front). A bond is purchased or held by an investor (debt is issued by a bank or financial institution and, so, the holder of the debt). A bond has a face value (for a debt we call this the principal). A bond provides periodic payments to the bond holder (the borrower sends periodic payments back to the bank for a debt or credit line). A bond is highly sensitive to the outside market environment (inflation, bond market fluctuations, competition, economic environment) and interest rates (higher prevailing interest rates mean lower bond price), and a credit line or debt is susceptible to the same pressures.

However, there are differences between a bond and regular debt or credit. A bond pays back the principal to the bond holder at maturity, whereas a debt’s or credit line’s principal amount is typically amortized over the life of the debt. However, there are amortizing bonds that provide the same payment as debt, and balloon debt that provides the same payments as bonds. Regardless of the type, both bond and debt have credit risk, prepayment risk, market risk, and other risks (e.g., sovereign and foreign exchange risk for international issues) and the cash flows can be determined up front, and, hence, the valuation approaches are very similar. In addition, for all the models introduced in this book in credit risk modeling, probability of default models, bond valuation, and debt options, we are assuming that these models and techniques are applicable to both regular debt and corporate bonds.

Figure 12.1: Credit risk analysis