File Name: Exotic Options – American Call Option on Foreign Exchange

Location: Modeling Toolkit | Real Options Models | American Call Option on Foreign Exchange

Brief Description: Computes American and European options on foreign exchange

Requirements: Modeling Toolkit, Real Options SLS

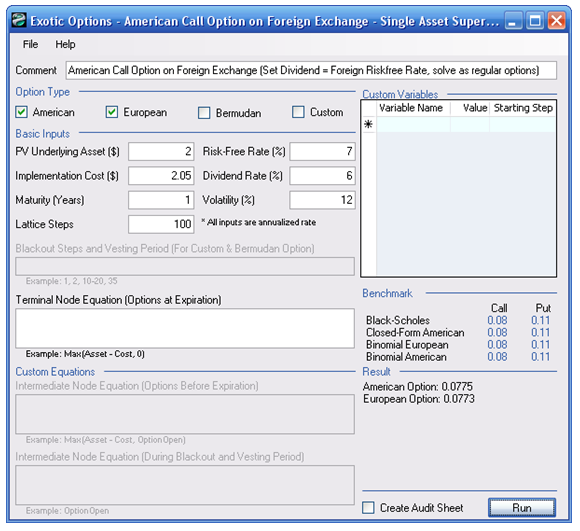

A Foreign Exchange Option (FX Option or FXO) is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a previously agreed-upon exchange rate on a specified date. The FX Options market is the deepest, largest, and most liquid market for options of any kind in the world. The valuation here uses the Garman-Kohlhagen model (Figure 32.1). You can use the Exotic Options – Currency (Foreign Exchange) Options model in the Modeling Toolkit software to compare the results of this Real Options SLS model. The exotic options model is used to compute the European version using closed-form models; the Real Options SLS model, the example showcased here, computes the European and American options using a binomial lattice approach. When using the binomial lattice approach in the Real Options SLS software, remember to set the Dividend Rate as the foreign country’s risk-free rate, PV Underlying Asset as the spot exchange rate, and Implementation Cost as the strike exchange rate.

As an example of a foreign exchange option, suppose the British pounds (GBP) versus the U.S. dollar (USD) is USD2/GBP1. Then the spot exchange rate is 2.0. Because the exchange rate is denominated in GBP (the denominator), the domestic risk-free rate is the rate in the United Kingdom, and the foreign rate is the rate in the United States. This means that the foreign exchange contract allows the holder the option to call GBP and put USD.

Figure 32.1: Foreign exchange option

To illustrate, suppose a U.K. firm is getting US$1M in six months, and the spot exchange rate is USD2/GBP1. If the GBP currency strengthens, the U.K. firm loses when it has to repatriate USD back to GBP but gains if the GBP currency weakens. If the firm hedges the foreign exchange exposure with an FXO and gets a call on GBP (put on USD), it hedges itself from any foreign exchange fluctuation risks. For discussion purposes, say the timing is short, interest rates are low, and volatility is low. Getting a call option with a strike of 1.90 yields a call value of approximately 0.10 (i.e., the firm can execute the option and gain the difference of 2.00 – 1.90, or 0.10, immediately). This means that the rate now becomes USD1.90/GBP1, and it is cheaper to purchase GBP with the same USD, or the U.K. firm gets a higher GBP payoff. In situations where volatility is nonzero and maturity is higher, there is a significant value in an FXO, which can be modeled using the Real Options SLS approach.