Theory

A stochastic process is a mathematically defined equation that can create a series of outcomes over time, outcomes that are not deterministic in nature; that is, an equation or process that does not follow any simple discernible rule such as price will increase X percent every year or revenues will increase by this factor of X plus Y percent. A stochastic process is by definition nondeterministic, and one can plug numbers into a stochastic process equation and obtain different results every time. For instance, the path of a stock price is stochastic in nature, and one cannot reliably predict the exact stock price path with any certainty. However, the price evolution over time is enveloped in a process that generates these prices. The process is fixed and predetermined, but the outcomes are not. Hence, by stochastic simulation, we create multiple pathways of prices, obtain a statistical sampling of these simulations, and make inferences on the potential pathways that the actual price may undertake given the nature and parameters of the stochastic process used to generate the time series. Four stochastic processes are included in Risk Simulator’s Forecasting tool, including Geometric Brownian motion or random walk, which is the most common and prevalently used process due to its simplicity and wide-ranging applications. The other three stochastic processes are the mean-reversion process, jump-diffusion process, and a mixed process.

The interesting thing about stochastic process simulation is that historical data is not necessarily required; that is, the model does not have to fit any sets of historical data. Simply compute the expected returns and the volatility of the historical data or estimate them using comparable external data or make assumptions about these values.

Procedure

- Start the module by selecting Risk Simulator | Forecasting | Stochastic Processes.

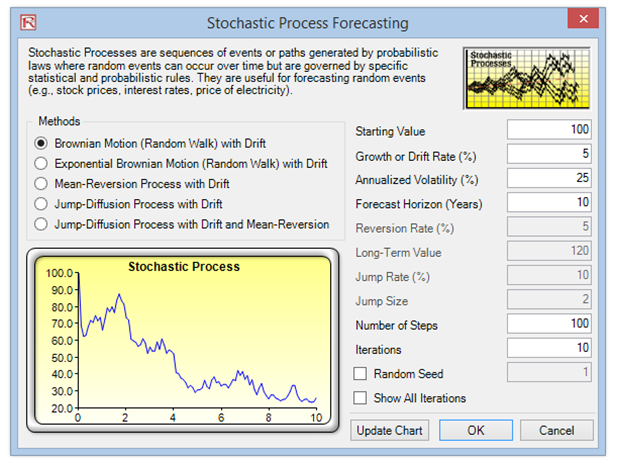

- Select the desired stochastic process, enter the required inputs, click on Update Chart a few times to make sure the process is behaving the way you expect it to, and click OK (Figure 11.9).

Results Interpretation

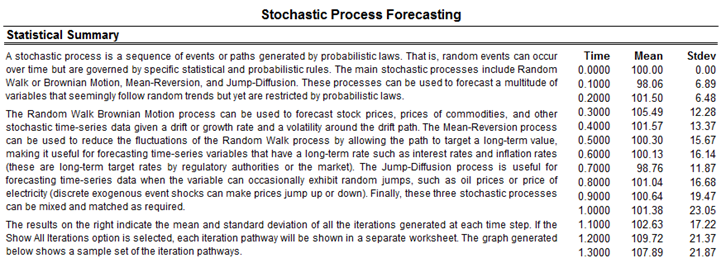

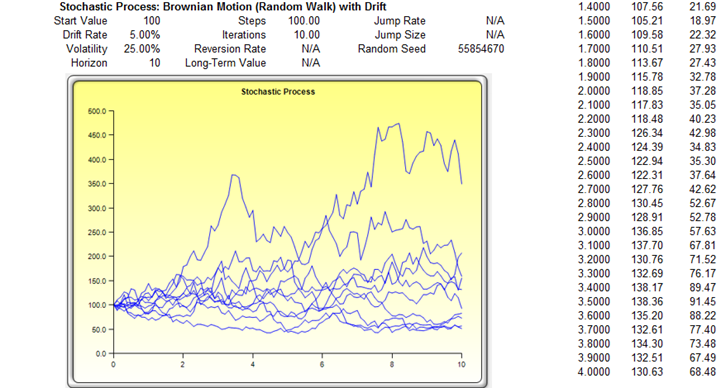

Figure 11.10 shows the results of a sample stochastic process. The chart shows a sample set of the iterations while the report explains the basics of stochastic processes. In addition, the forecast values (mean and standard deviation) for each time period is provided. Using these values, you can decide which time period is relevant to your analysis and set assumptions based on these mean and standard deviation values using the normal distribution. These assumptions can then be simulated in your own custom model.

For example, if you wish to determine the Year 1 forecast using the stochastic process model results, find an empty cell (e.g., cell A100) and set a simulation input assumption as Normal (mean of 101.38 and standard deviation of 23.05) based on the results in Figure 11.10. Then, in a nearby cell (e.g., cell A101), set it to equal the assumption cell’s value (i.e., in cell A101, set it to be =A100), and make this a simulation forecast cell. Run the simulation, and using the forecast chart, you can determine Year 1’s predicted mean simulated value, percentiles, and confidence intervals.

Figure 11.9: Stochastic Process Forecasting

Figure 11.10: Stochastic Forecast Result

Brownian Motion Random Walk Process

The Brownian motion random walk process takes the form of![]() for regular options simulation, or a more generic version takes the form of

for regular options simulation, or a more generic version takes the form of![]() for a geometric process. For an exponential version, we simply take the exponentials, and as an example, we have

for a geometric process. For an exponential version, we simply take the exponentials, and as an example, we have![]()

The following are the variable definitions:

S as the variable’s previous value

δS as the change in the variable’s value from one step to the next

μ as the annualized growth or drift rate

σ as the annualized volatility

In order to estimate the parameters from a set of time-series data, the drift rate, and volatility can be found by setting μ to be the average of the natural logarithm of the relative returns ![]() , while σ is the standard deviation of all

, while σ is the standard deviation of all ![]() values.

values.

Mean-Reversion Process

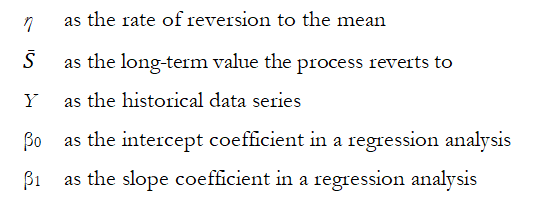

The following describes the mathematical structure of a mean-reverting process with drift:![]() In order to obtain the rate of reversion and long term rate, using the historical data points, run a regression such that

In order to obtain the rate of reversion and long term rate, using the historical data points, run a regression such that

![]() and we find

and we find ![]()

The following are the variable definitions:

Jump Diffusion Process

A jump-diffusion process is similar to a random walk process but there is a probability of a jump at any point in time. The occurrences of such jumps are completely random, but its probability and magnitude are governed by the process itself. The model is defined as![]() for a jump diffusion process.

for a jump diffusion process.

The following are the variable definitions:

Θ as the jump size of S

F(λ) as the inverse of the Poisson cumulative probability distribution

λ as the jump rate of S

The jump size can be found by computing the ratio of the post-jump to the pre-jump levels, and the jump rate can be imputed from past historical data. The other parameters are found the same way as above.