File Name: Exotic Options – Jump Diffusion

Location: Modeling Toolkit | Exotic Options | Jump Diffusion

Brief Description: Values an option whose underlying asset follows a stochastic jump-diffusion process

Requirements: Modeling Toolkit

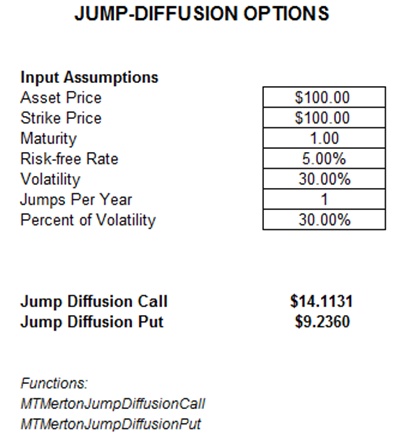

Modeling Toolkit Functions Used: MTMertonJumpDiffusionCall, MTMertonJumpDiffusionPut

A Jump-Diffusion Option is similar to a regular option except that instead of assuming that the underlying asset follows a lognormal Brownian Motion process, the process here follows a Poisson jump-diffusion process. That is, stock or asset prices follow jumps, which occur several times per year (observed from history). Cumulatively, these jumps explain a certain percentage of the total volatility of the asset. See Figure 59.1.

Figure 59.1: Jump-diffusion options