File Name: Exotic Options – Leptokurtic and Skewed Options

Location: Modeling Toolkit | Exotic Options | Leptokurtic and Skewed Options

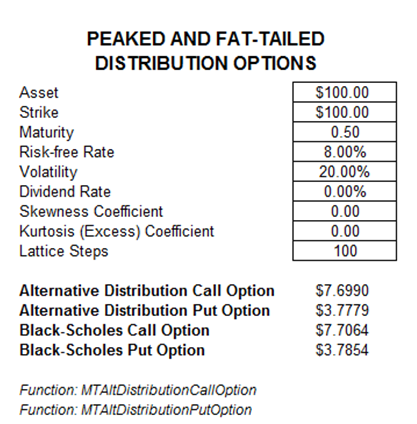

Brief Description: Computes options where the underlying assets are assumed to have returns that are skewed and leptokurtic or have fat tails and are leaning on one end of the distribution rather than having symmetrical returns

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTAltDistributionCallOption, MTAltDistributionPutOption

This model is used to compute the European call and put options using the binomial lattice approach when the underlying distribution of stock returns is not normally distributed, is not symmetrical, and has additional slight kurtosis and skew (Figure 60.1). Be careful when using this model to account for a high or low skew and kurtosis. Certain combinations of these two coefficients actually yield unsolvable results. The Black-Scholes results are also included to benchmark the effects of a high kurtosis and positive or negatively skewed distributions compared to the normal distribution assumptions on asset returns.

Figure 60.1: Leptokurtic options