File Name: Exotic Options – Futures Options

Location: Modeling Toolkit | Exotic Options | Futures and Forward Options

Brief Description: Applies the same generalities as the Black-Scholes model but the underlying asset is a futures or forward contract, not a stock

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTFuturesForwardsCallOption, MTFuturesForwardsPutOption

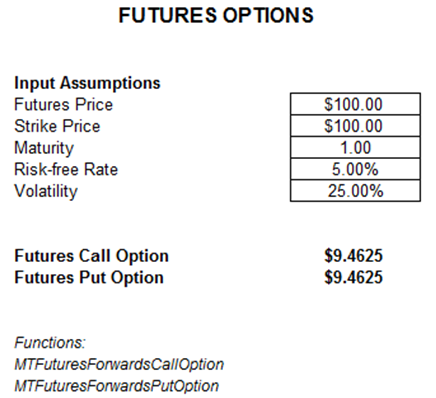

The Futures Option (Figure 54.1) is similar to a regular option, but the underlying asset is a futures or forward contract. Be careful here as the analysis cannot be solved using a Generalized Black-Scholes-Merton model. In many cases, options are traded on futures. A put is the option to sell a futures contract, and a call is the option to buy a futures contract. For both, the option strike price is the specified futures price at which the future is traded if the option is exercised.

Figure 54.1: Futures options

A futures contract is a standardized contract, typically traded on a futures exchange, to buy or sell a certain underlying instrument at a certain date in the future, at a prespecified price. The future date is called the delivery date or final settlement date. The preset price is called the futures price. The price of the underlying asset on the delivery date is called the settlement price. The settlement price normally converges toward the futures price on the delivery date.

A futures contract gives the holder the obligation to buy or sell, which differs from an options contract, which gives the holder the right but not the obligation to buy or sell. In other words, the owner of an options contract may exercise the contract. If it is an American-style option, it can be exercised on or before the expiration date; a European option can be exercised only at expiration. Thus, a Futures contract is more like a European option. Both parties of a “futures contract” must fulfill the contract on the settlement date. The seller delivers the commodity to the buyer, or, if it is a cash-settled future, cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset the position either by selling a long position or by buying back a short position, effectively closing out the futures position and its contract obligations.