File Name: Exotic Options – Graduated Barriers

Location: Modeling Toolkit | Exotic Options | Graduated Barriers

Brief Description: Values barrier options with flexible and graduated payoffs, depending on how far above or below a barrier the asset ends up at maturity

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTGraduatedBarrierDownandInCall, MTGraduatedBarrierDownandOutCall, MTGraduatedBarrierUpandInPut, MTGraduatedBarrierUpandOutPut

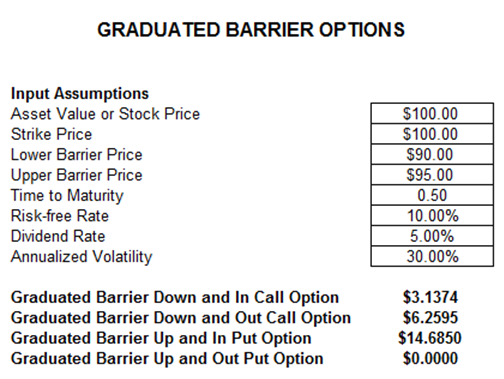

Graduated or Soft Barrier options are similar to standard Barrier options except that the barriers are no longer static values but a graduated range between the lower and upper barriers. The option is knocked in or out of the money proportionally. Both Upper and Lower Barriers should be either above (for Up and In or Up and Out options) or below (for Down and In or Down and Out options) the starting stock price or asset value. See Figure 56.1 for a sample valuation of Graduated Barrier options.

For instance, in the Down and In call option, the instruments become knocked-in or live at expiration if and only if the asset or stock value breaches the lower barrier (asset value goes below the barriers). If the option to be valued is a Down and In call, then both the Upper Barrier and the Lower Barrier should be lower than the starting stock price or asset value, providing a collar of graduated prices. For instance, if the upper and lower barriers are $90 and $80, and if the asset price ends up being $89, a down and out option will be knocked out 10% of its value. Standard barrier options are more difficult to delta hedge when the asset values and barriers are close to each other. Graduated barrier options are more appropriate for delta hedges, providing less delta risk and gamma risk.

Figure 56.1: Graduated barrier options