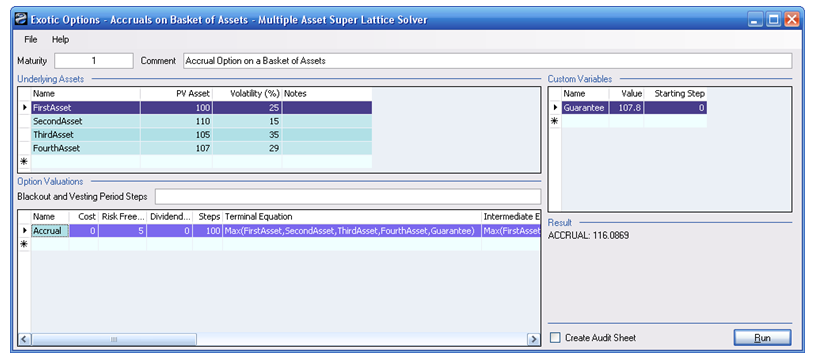

File Name: Exotic Options – Accruals on Basket of Assets

Location: Modeling Toolkit | Real Options Models | Accruals on Basket of Assets

Brief Description: Models the value of an accrual option on a basket or group of underlying assets

Requirements: Modeling Toolkit, Real Options SLS

Accruals on Basket instruments are essentially financial portfolios of multiple underlying assets where the holder of the instrument receives the maximum of the basket of assets or some prespecified guarantee amount. This instrument can be modeled as either an American option which can be executed at any time up to and including maturity; as a European option, which can be exercised only at maturity; or as a Bermudan option (exercisable only at certain times). Using the multiple assets and multiple phased module (MSLS) of the Real Options SLS software, we can model the value of an accrual option (Figure 30.1).

It is highly recommended that at this point, the reader first familiarizes him/herself with the basics of using the Real Options SLS Software chapter before attempting to solve any SLS models. Although using the SLS software, this model is listed in the section of Exotic Options because basket accruals are considered exotic options and are solved using similar methodologies as other exotics. The inputs are usual option inputs. The terminal and intermediate equations are shown next.

The Terminal Node Equation is:

Max(FirstAsset,SecondAsset,ThirdAsset,FourthAsset,Guarantee)

while the Intermediate Node Equation is:

Max(FirstAsset,SecondAsset,ThirdAsset,FourthAsset,OptionOpen)

Figure 30.1: Accruals on basket of assets (solved using SLS)