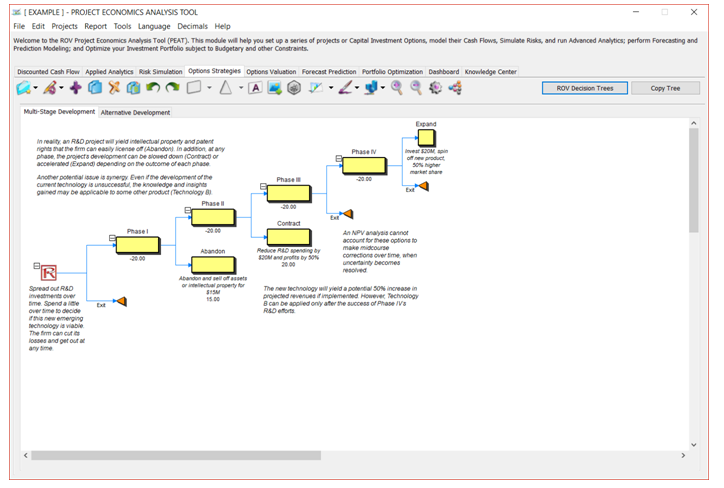

Options Strategies is where you can draw your own custom strategic map or strategic real options paths (Figure 6.1). This section only allows you to draw and visualize these strategic pathways and does not perform any computations. The next section, Options Valuation, actually does the computations. Feel free to explore this section’s capabilities but we recommend viewing the Video on Options Strategies (in the Knowledge Center | Getting Started Videos section of the software) to quickly get started on using this very powerful tool. You can also explore some preset options strategies by clicking on the First Icon and selecting any one of the Examples.

The default methodology shown is that of a Strategy Tree (i.e., only visual representations of strategic implementation pathways of investments with no computations performed; all quantitative computations and valuations are performed in the next tab, Options Valuation). Simulated dynamic decision trees are also available by clicking on the ROV Decision Trees button or the Last Icon (decision trees can be used to perform basic decision models as well as other more advanced methods like risk simulation on decision nodes, Bayes’ theorem applications and Bayes’ updating, expected value of information, utility functions analysis, and so forth). Below are some notes on the elements you will encounter in the software:

- Insert Option nodes or Insert Terminal nodes by first selecting any existing node and then clicking on the option node icon (square) or terminal node icon (triangle).

- Modify individual Option Node or Terminal Node properties by double-clicking on a node. Sometimes when you click on a node, all subsequent child nodes are also selected (this allows you to move the entire tree starting from that selected node). If you wish to select only that node, you may have to click on the empty background and click back on that node to select it individually. Also, you can move individual nodes or the entire tree starting from the selected node depending on the current setting (right-click, or in the Edit menu, and select Move Nodes Individually or Move Nodes Together)

- The following are some quick descriptions of the things that can be customized and configured in the node properties user interface. It is simplest to try different settings for each of the following to see its effects in the Strategy Tree:

-

- Name. Name shown above the node.

- Value. Value shown below the node.

- Excel Link. Links the value from an Excel spreadsheet’s cell.

- Notes. Notes can be inserted above or below a node.

- Show in Model. Show any combinations of Name, Value, and Notes.

- Local Color versus Global Color. Node colors can be changed locally to a node or globally.

- Label Inside Shape. Text can be placed inside the node (you may need to make the node wider to accommodate longer text).

- Branch Event Name. Text can be placed on the branch leading to the node to indicate the event leading to this node.

- Select Real Options. A specific real option type can be assigned to the current node. Assigning real options to nodes allows the tool to generate a list of required input variables.

- Global Elements are all customizable, including elements of the Strategy Tree’s Background, Connection Lines, Option Nodes, Terminal Nodes, and Text Boxes. For instance, the following settings can be changed for each of the elements:

- Font settings on Name, Value, Notes, Label, Event names.

- Node Size (minimum and maximum height and width).

- Borders (line styles, width, and color).

- Shadow (colors and whether to apply a shadow or not).

- Global Color.

- Global Shape.

- Example Files are available in the first icon menu to help you get started on building Strategy Trees.

- Protect File from the first icon menu allows the Strategy Tree to be encrypted with up to a 256-bit password encryption. Be careful when a file is being encrypted because if the password is lost, the file can no longer be opened.

- Capturing the Screen or printing the existing model can be done through the first icon The captured screen can then be pasted into other software applications.

- Add, Duplicate, Rename, and Delete a Strategy Tree can be performed through right-clicking the Strategy Tree tab or the Edit menu.

- You can also Insert File Link and Insert Comment on any option or terminal node or Insert Text or Insert Picture anywhere in the background or canvas area.

- You can Change Existing Styles or Manage and Create Custom Styles of your Strategy Tree (this includes size, shape, color schemes, and font size/color specifications of the entire Strategy Tree).

Options Valuation

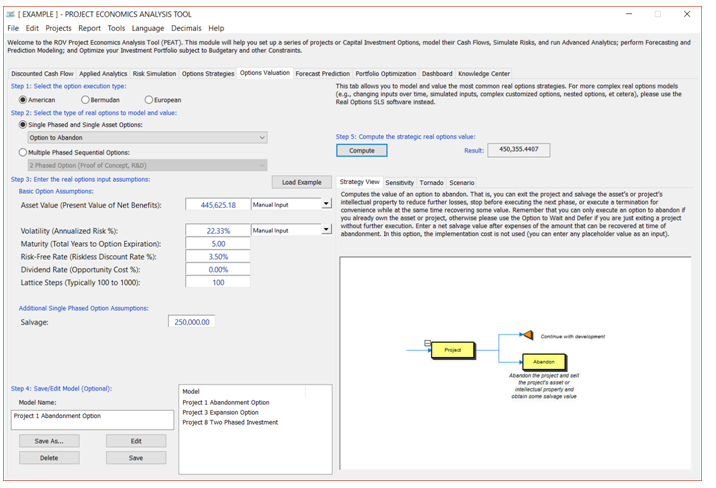

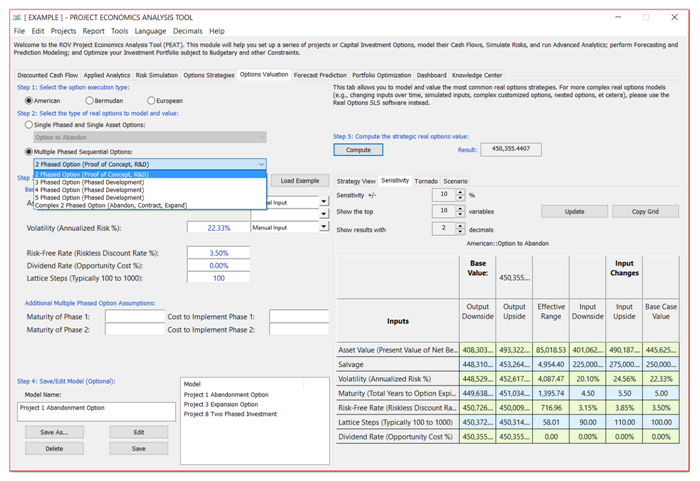

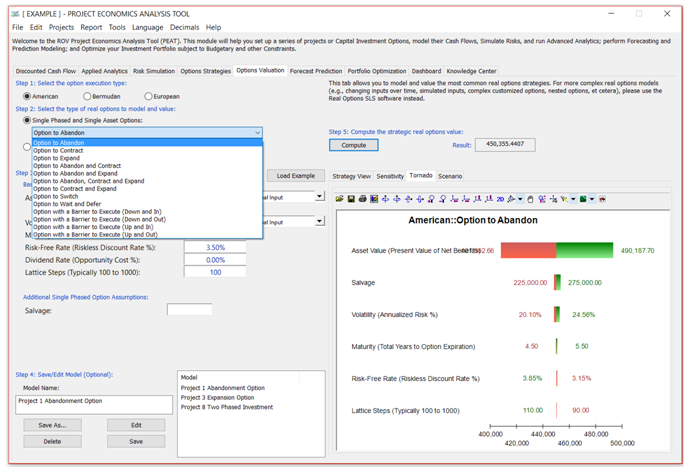

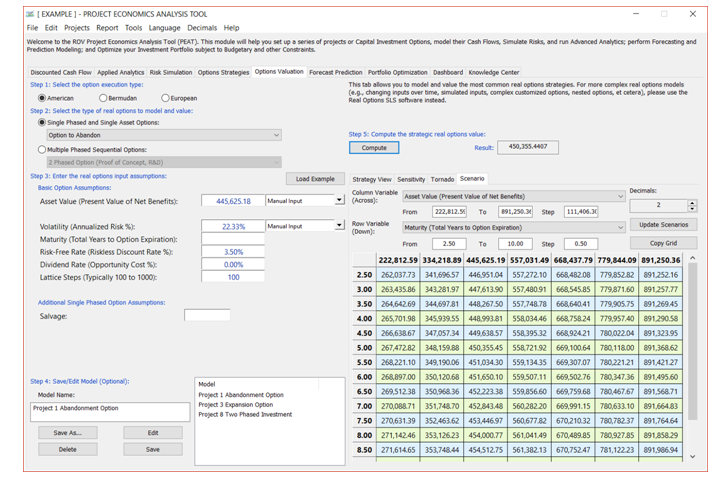

The Options Valuation section performs the calculations of Real Options Valuation models (Figures 6.2–6.5 show the results of using the default load example inputs). Make sure you understand the basic concepts of real options before proceeding. Briefly, start by choosing the option execution type (e.g., American, Bermudan, or European), select an option to model (e.g., single phased and single asset or multiple phased sequential options), and, based on the option types selected, enter the required inputs and click Compute. Some basic information and a sample strategic path are shown on the right under Strategy View. Also, a Tornado analysis and Scenario analysis can be performed on the option model, and you can Save As the options models for future retrieval.

You can click on Load Example to load an example set of inputs you can use as a guide to implementing your own option model, or click on the Manual Input droplists to automatically compute the inputs based on the projects you selected (i.e., some of the real options inputs will be linked to and computed from the outputs of the DCF model and simulation results).

Options Execution Types

- American Options can be executed at any time up to and including the maturity date.

- European Options can be executed only at one point in time, the maturity date.

- Bermudan Options can be executed at certain times and can be considered a hybrid of American and European Options. There is typically a blackout or vesting period when the option cannot be executed; but starting from the end of the blackout vesting date to the option’s maturity, the option can be executed.

Option to Wait and Execute

Buy additional time to wait for new information by pre-negotiating pricing and other contractual terms to obtain the option but not the obligation to purchase or execute something in the future should conditions warrant it (wait and see before executing).

- Run a Proof of Concept first to better determine the costs and schedule risks of a project versus jumping in right now and taking the risk.

- Build, Buy, or Lease. Developing internally or using commercially available technology or products.

- Multiple Contracts in place that may or not be executed.

- Market Research to obtain valuable information before deciding.

- Venture Capital small seed investment with right of first refusal before executing large-scale financing.

- Relative values of Strategic Analysis of Alternatives or Courses of Action while considering risk and the Value of Information.

- Contract Negotiations with vendors, acquisition strategy with industrial-based ramifications (competitive sustainment and strategic capability and availability).

- Project Evaluation and Capability ROI modeling.

- Capitalizing on other opportunities while reducing large-scale implementation risks and determining the value of Research & Development (parallel implementation of alternatives while waiting on technical success of the main project, and no need to delay the project because of one bad component in the project).

- Low Rate Initial Production, Prototyping, and Advanced Concept Technology Demonstration before full-scale implementation.

- Right of First Refusal contracts.

- Value of Information by forecasting cost inputs, capability, schedule, and other metrics.

- Hedging and Call- and Put-like options to execute something in the future with agreed-upon terms now, OTC Derivatives (Price, Demand, Forex, Interest Rate forwards, futures, options, swaptions for hedging).

Option to Abandon

Hedge downside risks and losses by being able to salvage some value of a failed project or asset that is out-of-the-money (sell intellectual property and assets, abandon and walk away from a project, buyback/sellback provisions).

- Exit and Salvage assets and intellectual property to reduce losses.

- Divestiture and Spin-off.

- Buyback Provisions in a contract.

- Stop and Abandon before executing the next phase.

- Termination for Convenience.

- Early Exit and Stop Loss Provisions in a contract.

Option to Expand

Take advantage of upside opportunities by having existing platforms, structures, or technologies that can be readily expanded (utility peaking plants, larger oil platforms, early/leapfrog technology development, larger capacity, or technology-in-place for future expansion).

- Platform Technologies.

- Mergers and Acquisitions.

- Built-in Expansion Capabilities.

- Geographical, Technological, and Market Expansion.

- Foreign Military Sales.

- Reusability and Scalability.

Option to Contract

Reduce downside risk but still participate in reduced benefits (counterparty takes over or joins in some activities to share profits; at the same time reduce your firm’s risk of failure or severe losses in a risky but potentially profitable venture).

- Outsourcing, Alliances, Contractors, Leasing.

- Joint Venture.

- Foreign Partnerships.

- Co-Development and Co-Marketing.

Portfolio Options

Combinations of options and strategic flexibility within a portfolio of nested options (path dependencies, mutually exclusive/inclusive, nested options).

- Determining the portfolio of projects’ capabilities to develop and field within Budget and Time Constraints, and what new Product Configurations to develop or acquire to field certain capabilities.

- Allows for different Flexible Pathways: Mutually Exclusive (P1 or P2 but not both), Platform/Prerequisite Technology (P3 requires P2, but P2 can be stand-alone; expensive and worth less if considered by itself without accounting for flexibility downstream options it provides for in the next phase), expansion options, abandonment options, parallel development or simultaneous compound options.

- Determining the Optimal Portfolios given budget scenarios that provide the maximum capability, flexibility, and cost effectiveness with minimal risks.

- Determining testing required in Modular Systems, mean-time-to-failure estimates, and Replacement and Redundancy requirements.

- Relative value of strategic Flexibility Options(options to Abandon, Choose, Contract, Expand, and Switch, and Sequential Compound Options, Barrier Options, and many other types of Exotic Options).

- Maintaining Capability and Readiness Levels.

- Product Mix, Inventory Mix, Production Mix.

- Capability Selection and Sourcing.

Sequential Options

Significant value exists if you can phase out investments over time, thereby reducing the risk of a one-time up-front investment (pharmaceutical and high technology development and manufacturing usually come in phases or stages).

- Stage-gate implementation of high-risk project development, prototyping, low-rate-initial-production, technical feasibility tests, technology demonstration competitions.

- Government contracts with multiple stages with the option to abandon at any time and valuing Termination for Convenience, and built-in flexibility to execute different courses of action at specific stages of development.

- P3I, Milestones, R&D, and Phased Options.

- Platform technology.

Options to Switch

Ability to choose among several options, thereby improving strategic flexibility to maneuver within the realm of uncertainty (maintain a foot in one door while exploring another to decide if it makes sense to switch or stay put).

- Ability to Switch among various raw input materials to use when prices of each raw material fluctuate significantly.

- Readiness and capability risk mitigation through switching vendors in an Open Architecture through Multiple Vendors and Modular Design.

Other Types of Real Options

Barrier Options, Custom Options, Exotic Options, Simultaneous Compound Option, Employee Stock Options, Options Embedded Contracts, Options with Blackout/Vesting Provisions, Options with Market and Change of Control Provisions, and many others!

Options Input Assumptions

- Asset Value. The underlying asset value before implementation costs. You can compute it by taking the NPV and adding back the sum of the present values of capital investments.

- Implementation Cost. The cost to execute the option (typically this is the cost to execute an option to wait or an option to expand).

- Volatility. The annualized volatility(a measure of risk and uncertainty, in percent) of the underlying asset.

- Maturity. The maturity of the option, denoted in years (e.g., a two-and-a-half-year option life can be entered as 2.5).

- Risk-free Rate. The interest-rate yield on a risk-free government bond with maturity commensurate to that of the option.

- Dividend Rate. The annualized opportunity cost of not executing the option, as a percentage of the underlying asset.

- Lattice Steps. The number of binomial or multinomial lattice steps to run in the model. The typical number we recommend is between 100 and 1000, and you can check for convergence of the results. The larger the number of lattice steps, the higher the level of convergence and granularity (i.e., the number of decimal precision).

- Blackout Year. The vesting period entered in years, during which the option cannot be executed (European), but the option converts to an American on the date of this vesting period through to its maturity.

- Maturity of Phases. The number of years to the end of each phase in a sequential compound option model.

- Cost to Implement Phases. The costs to execute each of the subsequent phases in a sequential compound option, and they can be set to zero or a positive value.

- Expansion Factor. The relative ratio increase in the underlying asset when the option to expand is executed (typically this is greater than 1).

- Contraction Factor. The relative ratio reduction in the underlying asset when the option to contract is executed (typically this is less than 1).

- Savings. The net savings received by contracting operations.

- Salvage. The net sales amount after expenses of abandoning an asset.

- Barrier. The upper or lower barrier of an option whereupon if the underlying asset breaches this barrier, the option becomes either live or worthless, depending on the type of option modeled.

Figure 6.1 – Options Strategies

Figure 6.2 – Options Valuation: Input Assumptions and Strategy View

Figure 6.3 – Options Valuation: Sensitivity Analysis on Options

Figure 6.4 – Options Valuation: Tornado Analysis on Options

Figure 6.5 – Options Valuation: Scenario Analysis on Options

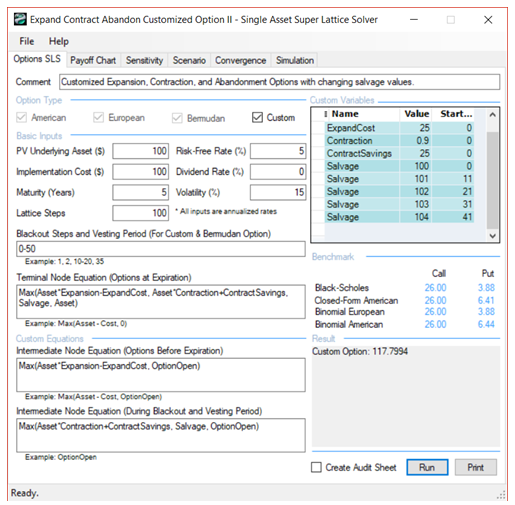

Real Options SLS Software Tool

PEAT’s Options Valuation tab is a simplified version of options analysis in the sense that the most common strategic real options have been incorporated into the software, and all you need to do is select the option you want valued, enter the required assumptions, and compute. The analysis is also backed by Tornado Analysis, Sensitivity Analysis, and Scenario Analysis. However, for more advanced or customized options, please use ROV’s other software tool, Real Options Super Lattice Solver (SLS) as seen in Figure 6.6, where more advanced analytical models can be created (Figure 6.7).

Figure 6.6 – Real Options Super Lattice Solver (SLS) Software

Figure 6.7 – Real Options Super Lattice Solver (SLS) Software: Sample Customized Option