File Name: Exotic Options – Simple Chooser

Location: Modeling Toolkit | Exotic Options | Simple Chooser

Brief Description: Computes the value of an option that can become either a call or a put

Requirements: Modeling Toolkit, Real Options SLS

Modeling Toolkit Functions Used: MTChooserBasicOption, MTGeneralizedBlackScholesCall, MTGeneralizedBlackScholesPut

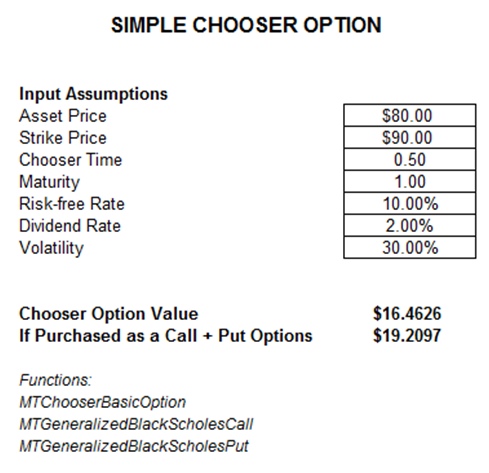

A Simple Chooser Option allows the holder the option to choose if the option is a call or a put within the Chooser Time. Regardless of the choice, the option has the same contractual strike price and maturity. Typically, a chooser option is cheaper than purchasing both a call and a put together but provides the same level of hedge at a lower cost. The strike prices for both options are identical. The Complex Chooser Option in the next chapter allows for different strike prices and maturities. Figure 41.1 gives an example of computing the value of a simple chooser option.

Figure 41.1: Computing a simple exotic chooser option