Theory

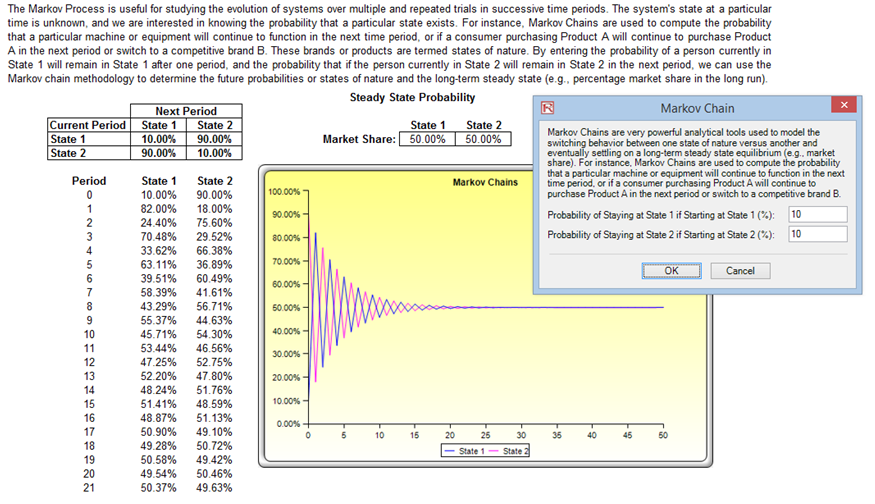

A Markov chain exists when the probability of a future state depends on a previous state and when linked together forms a chain that reverts to a long-run steady-state level. This Markov approach is typically used to forecast the market share of two competitors. The required inputs are the starting probability of a customer in the first store (first state) returning to the same store in the next period versus the probability of switching to a competitor’s store in the next state.

Procedure

- Start Excel and select Risk Simulator | Forecasting | Markov Chain.

- Enter the required input assumptions(see Figure 11.19 for an example) and click OK to run the model and report.

Note

Set both probabilities to 10% and rerun the Markov chain, and you will see the effects of switching behaviors very clearly in the resulting chart shown in Figure 11.19.

Markov Chain

Figure 11.19: Markov Chains (Switching Regimes)