File Name: Credit Analysis – Internal Credit Risk Rating Model

Location: Modeling Toolkit | Credit Analysis | Internal Credit Risk Rating Model

Brief Description: Determines the credit shortfall risk and alphabetical risk rating given the probability of default

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTCreditRatingWidth, MTCreditRiskShortfall

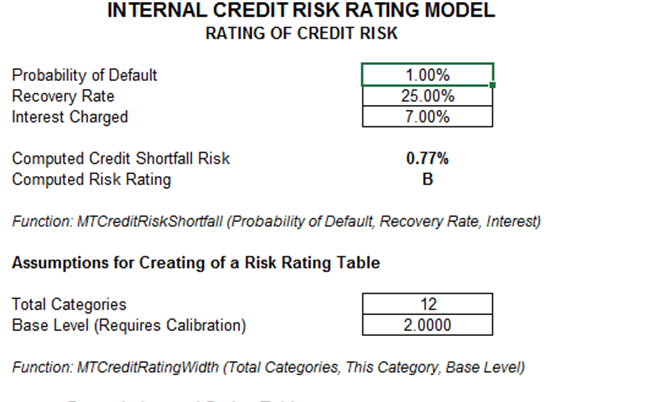

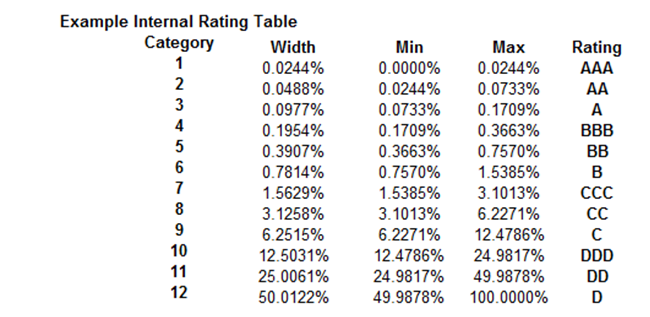

This is an internal credit rating model similar to the ones used by Moody’s or other rating agencies. Obtain the required probability of default input from other probability of default models in the Modeling Toolkit (see the chapters on modeling probability of default later in this book) and use this model to determine the rating of this company or debt holder. To further enhance the model, the category widths of the rating table can be refined and calibrated through additional parameter-width estimates, given actual data. For instance, Figure 14.1 illustrates how a ratings table can be generated. This model shows how the previous model, the External Ratings and Spreads example, is generated. That is, by entering the desired number of total categories for the risk ratings table and the base level (which requires calibration with actual data, and typically ranges between 1.1 and 3.0), you can develop the ratings table and determine the risk rating and credit risk shortfall, given some probability of default, recovery rate, and interest charged to a company. In some instances, the base level can be calibrated using a backcasting approach, where several base-level values are tested using various probabilities of default, and the resulting risk rating is used to benchmark against other industry standards.

Figure 14.1: Internal credit risk rating model and risk table generation