File Name: Exotic Options – Min and Max of Two Assets

Location: Modeling Toolkit | Exotic Options | Min and Max of Two Assets

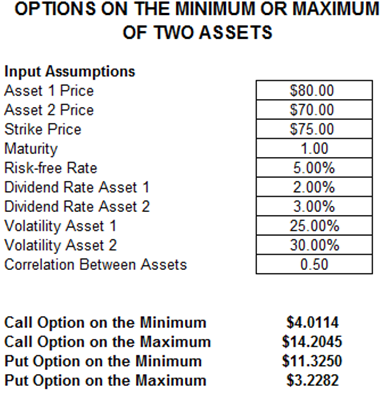

Brief Description: Computes the value of an option where there are two underlying assets that are correlated with different volatilities, and the differences between the assets’ values are used as the benchmark for determining the value of the payoff at expiration

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTCallOptionOnTheMin, MTCallOptionOnTheMax, MTPutOptionOnTheMin, MTPutOptionOnTheMax

Options on Minimum or Maximum are used when there are two assets with different volatilities. Either the maximum or the minimum value at the expiration of both assets is used in the option exercise. For instance, a call option on the minimum implies that the payoff at expiration is such that the minimum price between Asset 1 and Asset 2 is used against the strike price of the option (Figure 65.1).

Figure 65.1: Options on the min and max between two assets