File Name: Exotic Options – Cash or Nothing

Location: Modeling Toolkit | Exotic Options | Cash or Nothing

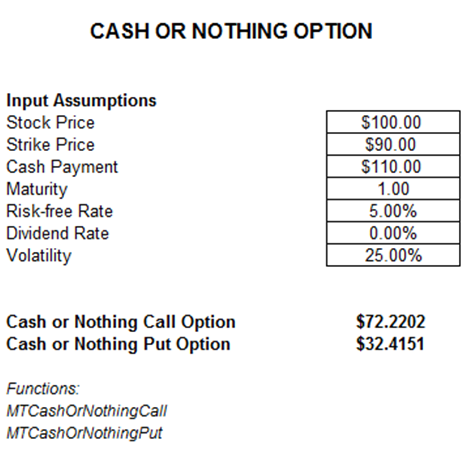

Brief Description: Computes the cash or nothing option, where if in the money at expiration, the holder receives some prespecified cash amount

Requirements: Modeling Toolkit, Real Options SLS

Modeling Toolkit Functions Used: MTCashOrNothingCall, MTCashOrNothingPut

A Cash or Nothing Option is exactly what it implies: At expiration, if the option is in the money, regardless of how deep it is in the money, the option holder receives a pre-determined cash payment. This means that for a call option, as long as the stock or asset price exceeds the strike at expiration, cash is received. Conversely, for a put option, cash is received only if the stock or asset value falls below the strike price. An example of computing cash or nothing option is shown in Figure 40.1.

Figure 40.1: Computing cash or nothing options