File Name: Credit Analysis – External Debt Rating and Spreads

Location: Modeling Toolkit | Credit Analysis | External Debt Rating and Spreads

Brief Description: Simulates and computes the credit risk spread of a particular firm based on industry standards (EBIT and interest expenses of the debt holder) to determine the risk-based spread

Requirements: Modeling Toolkit, Risk Simulator

This model is used to run a simulation on a company’s creditworthiness given that the earnings are uncertain. The goal is to determine the credit category this firm is in, given its financial standing and the industry it operates in. Assuming we have a prespecified credit category for various industries (see the various Credit Risk Rating models in the Modeling Toolkit for examples on how to determine the creditworthiness of a customer or company using internal and external risk-based models and how the credit category and scoring table is obtained as well as using Modeling Toolkit’s probability of default models to determine the creditworthiness of an obligor), we can then determine what interest rate to charge the company for a new loan.

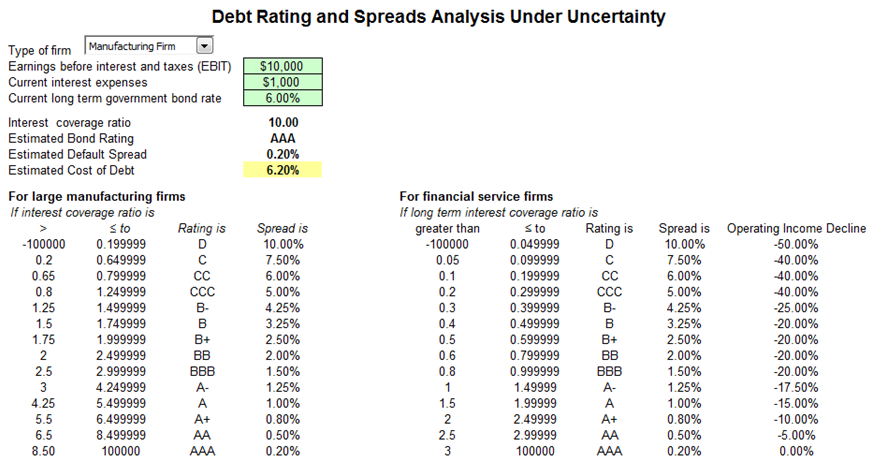

For instance, Figure 13.1 illustrates a manufacturing firm’s earnings before interest and taxes (EBIT) as well as its current interest expenses and benchmarked against some long-term government bond rates. Using industry standards, the debt is then rated appropriately using a predefined credit rating table, and the default spread and total interest charge are then computed.

This model is very similar to the examples described in the previous two chapters in that the relevant credit spread is determined for a risky debt. In Chapter 9, given a probability of default (we discuss the applications of the probability of default models in detail later in the book), we can determine the relevant credit spread. In Chapter 11, given the credit spread, we can determine the impact on the price of a bond or risky debt. In this chapter, we are interested in obtaining the spread on risky debt by looking at industry comparables and using other financial ratios such as a company’s interest coverage. This approach is more broad-based and can be used assuming no other financial data are available.

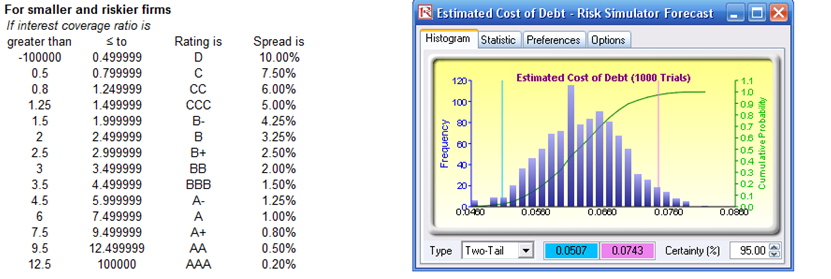

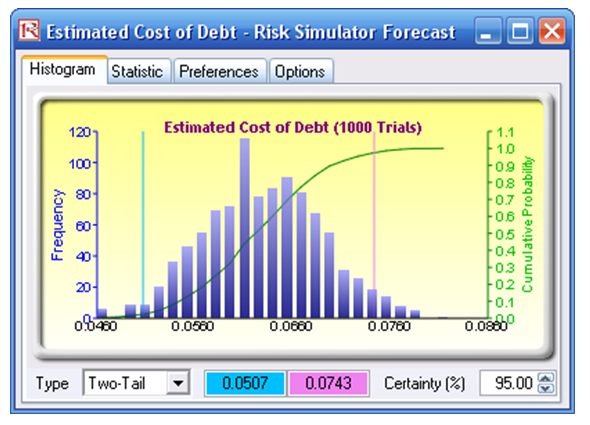

Each of the inputs can be simulated using Risk Simulator to determine the statistical confidence of the cost of debt or interest rate to charge the client (see Figure 13.2). By running a simulation, we can better estimate the relevant credit spread and its confidence interval, rather than relying on a single snapshot value of some financial ratios to determine the credit spread.

Figure 13.1: Simulating debt rating and spreads

Figure 13.2: Forecast distribution of interest rate with spreads