File Name: Valuation – Classified Loan Borrowing Base

Location: Modeling Toolkit | Valuation | Classified Loan Borrowing Base

Brief Description: Illustrates how to value and classify a loan based on accounts receivable valuation

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Functions Used: MTCreditAcceptanceCost, MTCreditRejectionCost

Special Credits: This model was contributed by Prof. Morton Glantz. He is a financial consultant, educator, and advisor to corporate financial executives, government ministers, privatization managers, investment and commercial bankers, public accounting firms, members of merger and acquisition teams, strategic planning executives, management consultants, attorneys, and representatives of foreign governments and international banks. As a senior officer of JP Morgan Chase, he specialized in credit analysis and credit risk management, risk grading systems, valuation models, and professional training. Morton is on the finance faculty at the Fordham Graduate School of Business. He has appeared in the Harvard University International Directory of Business and Management Scholars and Research and earned Fordham University Deans Award for Faculty Excellence on three occasions, a school record. His areas of expertise include Advanced Forecasting Methods, Advanced Credit Risk Analysis, Credit Portfolio Risk Management, Essentials of Corporate Finance, Corporate Valuation Modeling and Analysis, Credit Risk Analysis and Modeling, Project Finance, and Corporate Failure. He has authored a number of books including: Credit Derivatives: Techniques to Manage Credit Risk for Financial Professionals, (with Erik Banks and Paul Siegel), McGraw Hill 2006; Optimal Trading Strategies, AMACOM 2003 (co-author: Dr. Robert Kissell); Managing Bank Risk: An Introduction to Broad-Base Credit Engineering, Academic Press/Elsevier 2002 (RISKBOOK.COM Award: Best Finance Books of 2003); Scientific Financial Management, AMACOM 2000; Loan Risk Management, McGraw Hill (1995); and The Banker’s Handbook on Credit Risk, with Dr. Johnathan Mun, Academic Press (2008).

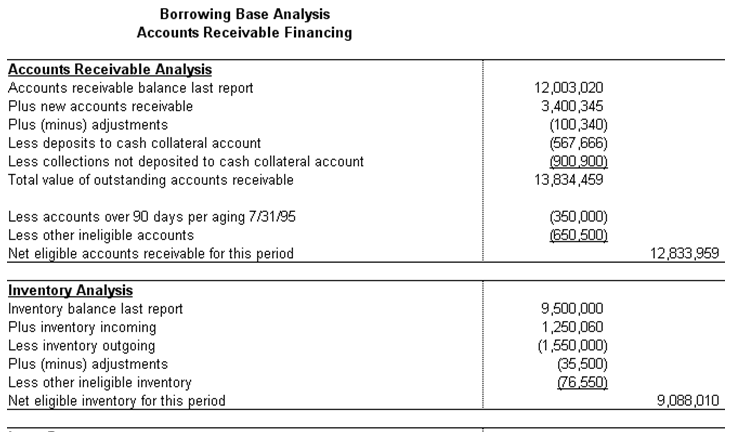

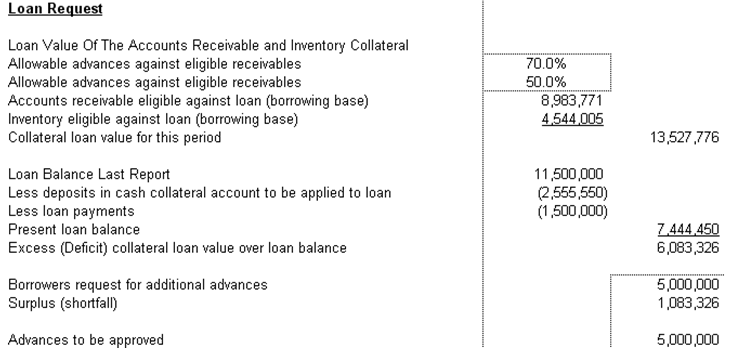

The key characteristic of a borrowing base workout loan is the fact that the amount a borrower may borrow at any one time is restricted by both the total exposure allowed under the applicable workout agreement and by the borrowing base. Borrowing base loans are not limited to workout loans. This is in contrast to the traditional loans where, as long as the borrower complies with loan covenants, he or she may draw down the entire loan facility. The borrowing base in an asset-based loan may consist of accounts receivable, inventory, equipment, and even real estate. Collateral quality and these collaterals can be converted into cash influences amount (the level of cash advance) approved. This models the creditworthiness of a borrower given that the loan is backed by accounts receivables of the debt holder’s firm. In this model, we can determine the probability that the loan will be paid back and determine if the loan should be issued or not. See Figure 151.1.

Figure 151.1: Borrowing base accounts receivable model

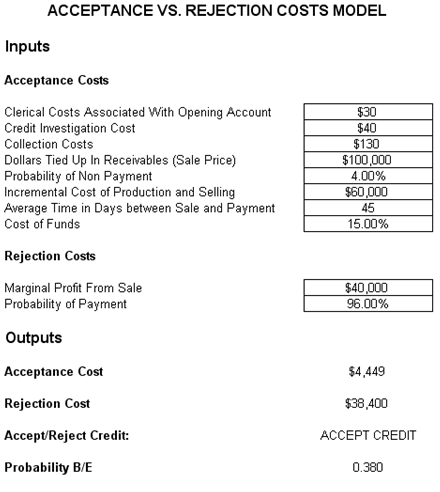

This model is similar to accept-reject decisions in capital budgeting whereby the specific application introduced here is in the area of “problem loans” where the loan workout exercise is to control the distressed-borrower approval based on orders sold on credit, such as accounts receivable. The model reveals the relationship between marginal returns and marginal costs of approving an order and granting credit terms. For example, if acceptance costs are below rejection costs on an incremental order, the opportunity cost of rejecting the credit is too much; thus the credit would be accepted. The model is a powerful tool in problem loan turnarounds. For example, the banker would allow the distressed borrower to approve a weak credit order, if the incremental cost of production was very low because even if the receivable went bad, the borrower would not lose much if the incremental cost of manufacturing a widget was $1.00 while the widget was sold for $100.00.

The model can be made stochastic because there are assumption variables, forecast variables, and possibly constraints. The Acceptance/Rejection Costs part of the model serves as a framework for evaluating decisions on changing credit policies (Figure 151.2).

Figure 151.2: Acceptance and rejection costs of new credit