File Name: Basic American, European, versus Bermudan Call Options

Location: Modeling Toolkit | Real Options

Brief Description: Compares and values the three different types of option, American (exercisable at any time), Bermudan (exercisable at certain times), and European (exercisable only at expiration), where dividends exist and when dividends do not exist

Requirements: Modeling Toolkit, Real Options SLS

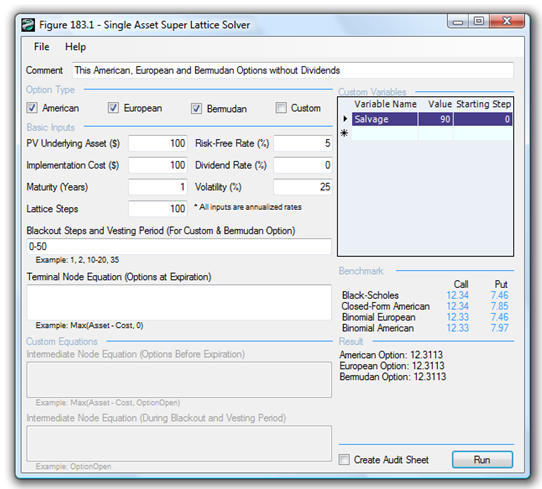

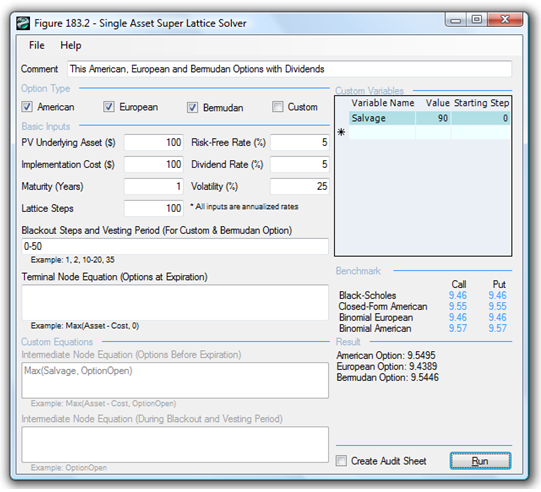

Figure 178.1 shows the computation of basic American, European, and Bermudan Options without dividends, while Figure 178.2 shows the computation of the same options but with a dividend yield. Of course, European Options can be executed only at termination and not before, while in American Options, early exercise is allowed, versus a Bermudan Option where early exercise is allowed except during blackout or vesting periods. Notice that the results for the three options without dividends are identical for simple call options, but they differ when dividends exist. When dividends are included, the simple call option values for American ≥ Bermudan ≥ European in most basic cases, as seen in Figure 178.2. Of course, these generalities can be applied only to plain vanilla call options and do not necessarily apply to other exotic options (e.g., Bermudan options with vesting and suboptimal exercise behavior multiples sometimes carry a higher value when blackouts and vesting occur than regular American options with the same suboptimal exercise parameters).

Figure 178.1: Simple American, Bermudan, and European options without dividends

Figure 178.2: Simple American, Bermuda, and European options with dividends