File Name: Exotic Options – Two Asset Barrier

Location: Modeling Toolkit | Exotic Options | Two Asset Barrier

Brief Description: Computes the value of an option with two underlying assets, one of which is a reference benchmark, with the second asset being used to compute the value of the option payoff

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTTwoAssetBarrierDownandInCall, MTTwoAssetBarrierUpandInCall, MTTwoAssetBarrierDownandInPut, MTTwoAssetBarrierUpandInPut, MTTwoAssetBarrierDownandOutCall, MTTwoAssetBarrierUpandOutCall, MTTwoAssetBarrierDownandOutPut, MTTwoAssetBarrierUpandOutPut

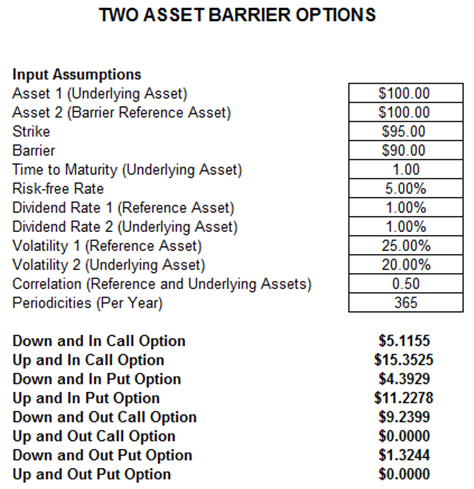

Two-Asset Barrier Options become valuable or get knocked in the money only if a barrier (upper or lower barrier) is breached (or not), and the payout is in the form of the option on the first underlying asset. In general, a barrier option limits the potential of a regular option’s profits and hence costs less than regular options without barriers. A barrier option thus is a better bet for companies trying to hedge a specific price movement as it tends to be cheaper. See Figure 75.1.

As an example, in the Up and In Call Option, the instrument is knocked in if the asset breaches the upper barrier but is worthless if this barrier is not breached. The payoff on this option is based on the value of the first underlying asset (Asset 1) less the Strike price, while whether the barrier is breached or not depends on whether the second reference asset (Asset 2) breaches the Barrier. Monitoring Periodicities refers to how often during the life of the option the asset or stock value will be monitored to see if it breaches a barrier. As an example, entering 12 implies monthly monitoring, 52 for weekly, 252 for daily trading, 365 for the daily calendar, and 1,000,000 for continuous monitoring.

Figure 75.1: Two-asset barrier options