File Name: Debt Analysis – Asset-Equity Parity Model

Location: Modeling Toolkit | Debt Analysis | Asset-Equity Parity Model

Brief Description: Applies the asset-equity parity relationship to determine the market value of risky debt and its required return, as well as the market value of the asset and its volatility

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTAEPMarketValueDebt, MTAEPMarketValueAsset, MTAEPRequiredReturnDebt

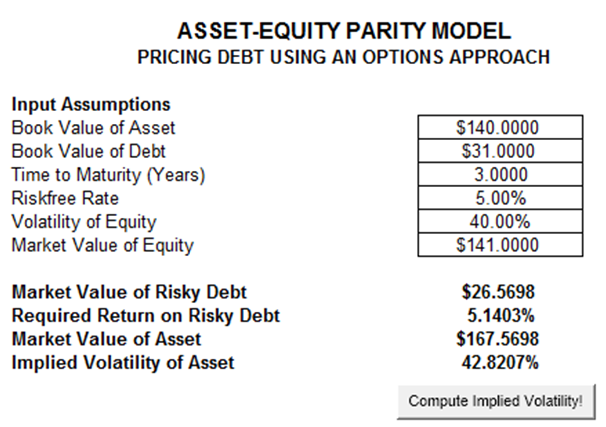

This model applies the Asset-Equity Parity assumptions, whereby given the company’s book values of debt and asset, and the market value of equity and its corresponding volatility, we can determine the company’s market value of risky debt and the required return on the risky debt in the market, and impute the market value of the company’s assets and the asset’s volatility. Enter the relevant inputs and click on Compute Implied Volatility to determine the implied volatility of the asset (Figure 16.1).

This model applies the basic parity assumption that the assets of a company equal any outstanding equity plus its liabilities. In publicly traded companies, the equity value and equity volatility can be computed using available stock prices, while the liabilities of the firm can be readily quantified based on financial records. However, the market value and volatility of the firm’s assets are not available or easily quantified (contrary to the book value of asset, which can be readily obtained through financial records). These values are required in certain financial, options, and credit analyses and can be obtained only through this Asset-Equity Parity model. In addition, using the equity volatility and book value of debt, we can also impute the market value of debt and the required return on risky debt.

This concept of asset-equity-options parity is revisited later in the chapters on the probability of default models. Briefly, equity owners (stockholders) of a firm have the option to pay off the firm’s debt to own 100% of the firm’s assets. That is, assets in a public company are typically funded by debt and equity, and although debt has a higher priority for repayment (especially in default and bankruptcy situations), only equity holders can cast votes to determine the fate of the company, including the ability and option to pay off all remaining debt and own all of the firm’s assets. Therefore, there is an options linkage among debt, equity, and asset levels in a company, and we can take advantage of this linkage (through some simultaneous stochastic equations modeling and optimization) to obtain the firm’s market value of an asset, asset volatility, market value of debt, and, discussed in later chapters, the probability of default of the firm.

Figure 16.1: Asset-Equity options model