File Name: Debt Analysis – Merton Price of Risky Debt with Stochastic Asset and Interest

Location: Modeling Toolkit | Debt Analysis | Merton Price of Risky Debt with Stochastic Asset and Interest

Brief Description: Computes the market value of risky debt using the Merton option approach, assuming that interest rates are mean-reverting and volatile, while further assuming that the company’s internal assets are also stochastic and changing over time

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Function Used: MTBondMertonBondPrice

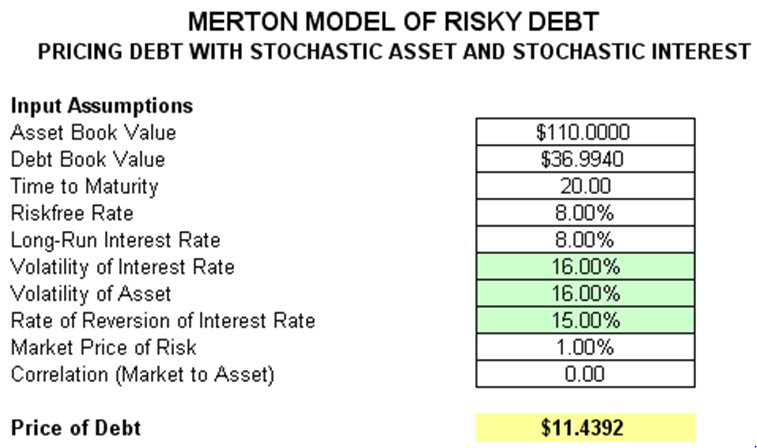

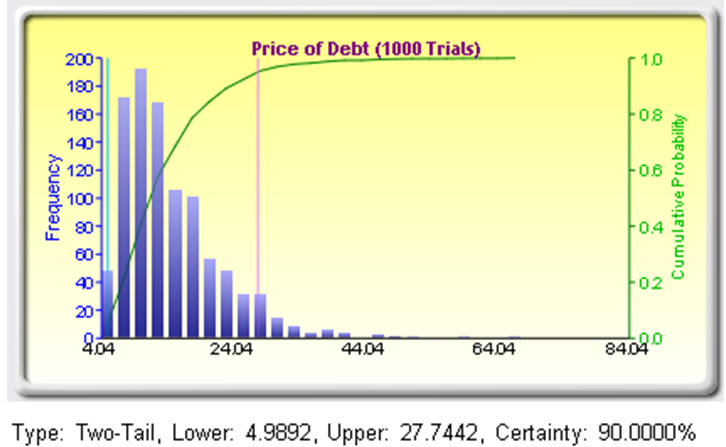

The Merton model for risky debt computes the market value of debt while taking into account the book values of assets and debt in a company as well as the volatility of interest rates and asset value over time. The interest rate is assumed to be stochastic in nature and is mean-reverting, at some rate of reversion, to a long-term value (Figure 20.1). Further, the model also requires as inputs the market price of risk and the correlation of the company’s asset value to the market. You can set the correlation and market price of risk to zero for indeterminable conditions, while the rate of reversion and long-run interest rates can be determined and modeled using Risk Simulator’s Statistical Analysis tool. Simulation on any of the inputs can also be run using Risk Simulator to determine the risk and statistical confidence of the market price of risky debt (Figure 20.2). This model is similar in nature to the Cox mean-reverting model where both assume that the underlying debt instrument is highly sensitive to fluctuations in interest rates. The difference would be that this Merton model accounts for stochastic interest rates as well as stochastic asset movements, and that the market is used to calibrate the movements of the asset value (the correlation between asset and market returns is a required input).

Figure 20.1: Merton model of risky debt assuming stochastic interest and asset movements

Figure 20.2: Forecast distribution of price of risky debt