File Name: Exotic Options – Binary Digital Options

Location: Modeling Toolkit | Exotic Options | Binary Digital Options

Brief Description: Computes various binary digital options that either knocked in or out of the money depending on if the asset value breaches certain barriers

Requirements: Modeling Toolkit, Real Options SLS

Modeling Toolkit Functions Used: MTBinaryDownAndInCashAtExpirationOrNothingCall,

MTBinaryUpAndInCashAtExpirationOrNothingCall, MTBinaryDownAndInAssetAtExpirationOrNothingCall, MTBinaryUpAndInAssetAtExpirationOrNothingCall, MTBinaryDownAndOutCashAtExpirationOrNothingCall, MTBinaryUpAndOutCashAtExpirationOrNothingCall, MTBinaryDownAndOutAssetAtExpirationOrNothingCall, MTBinaryUpAndOutAssetAtExpirationOrNothingCall, MTBinaryDownAndInCashAtExpirationOrNothingPut, MTBinaryUpAndInCashAtExpirationOrNothingPut, MTBinaryDownAndInAssetAtExpirationOrNothingPut, MTBinaryUpAndInAssetAtExpirationOrNothingPut, MTBinaryDownAndOutCashAtExpirationOrNothingPut, MTBinaryUpAndOutCashAtExpirationOrNothingPut, MTBinaryDownAndOutAssetAtExpirationOrNothingPut, MTBinaryUpAndOutAssetAtExpirationOrNothingPut

Binary exotic options (also known as Digital, Accrual, or Fairway options) become valuable only if a barrier (upper or lower barrier) is breached (or not), and the payout could be in the form of some prespecified cash amount or the underlying asset itself. The cash or asset exchanges hands either at the point when the barrier is breached or at the end of the instrument’s maturity (at expiration) assuming that the barrier is breached at some point prior to maturity.

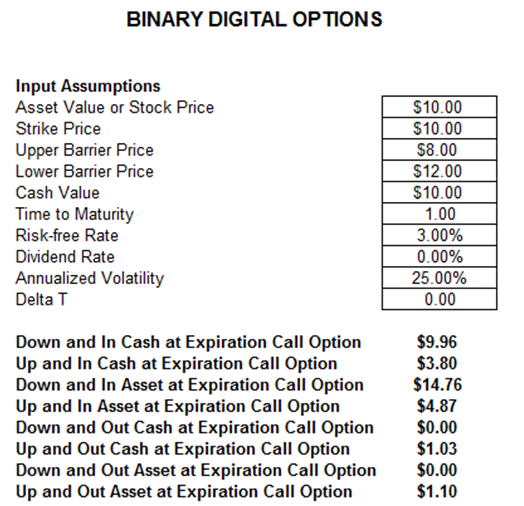

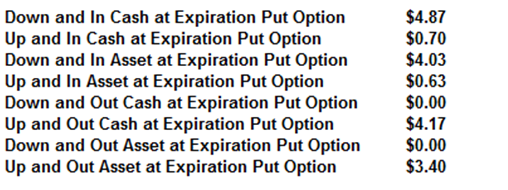

For instance, in the Down and In Cash at Expiration option, the instruments pay the specified cash amount at expiration if and only if the asset value breaches the lower barrier (the asset value goes below the lower barrier), providing the holder of the instrument a safety net or cash insurance in case the underlying asset does not perform well. With Up and In options, the cash or asset is provided if the underlying asset goes above the upper barrier threshold. In Up and Out or Down and Out options the asset or cash is paid as long as the upper or lower barrier is not breached. With At Expiration options, cash and assets are paid at maturity, whereas the At Hit instruments are payable at the point when the barrier is breached. Figure 39.1 provides an example of computing binary digital options.

Figure 39.1: Computing binary digital options