File Name: Risk Hedging – Hedging Forex Exposures

Location: Modeling Toolkit | Risk Hedging | Foreign Exchange Exposure Hedging

Brief Description: Illustrates how to use Risk Simulator for simulating foreign exchange rates to determine the value of a hedged currency option position

Requirements: Modeling Toolkit, Risk Simulator

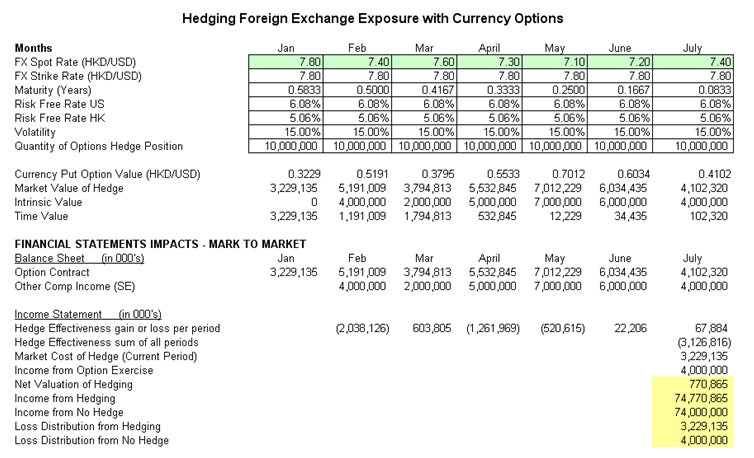

This model is used to simulate possible foreign exchange spot and future prices and the effects on the cash flow statement of a company under a freely floating exchange rate versus using currency options to hedge the foreign exchange exposure. See Figure 128.1.

Figure 128.1: Hedging currency exposures with currency options

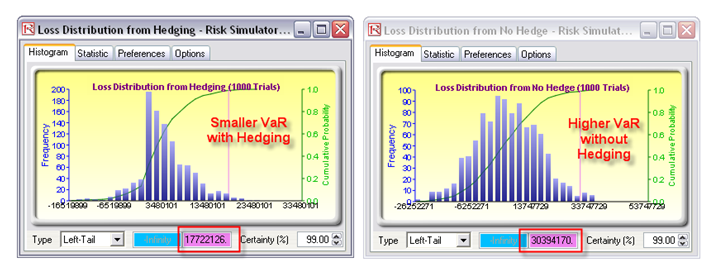

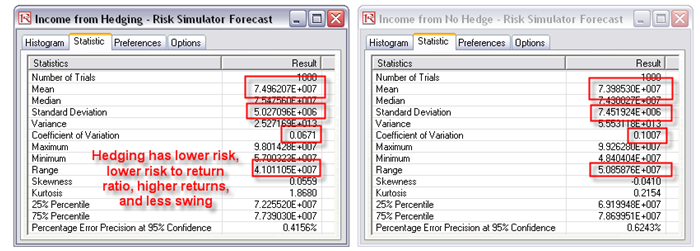

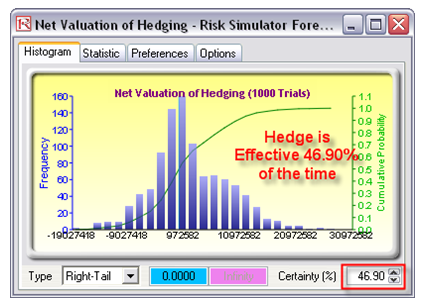

Figure 128.2 shows the effects of the Value at Risk (VaR) of a hedged versus unhedged position. Clearly, the right-tailed VaR of the loss distribution is higher without the currency options hedge. Figure 128.3 shows that there is a lower risk, lower risk to returns ratio, higher returns, and less swing in the outcomes of a currency-hedged position than an exposed position. Finally, Figure 128.4 shows the hedging effectiveness, that is, how often the hedge is in the money and becomes usable.

Figure 128.2: Values at Risk (VaR) of hedged versus unhedged positions

Figure 128.3: Forecast statistics of the loss distribution

Figure 128.4: Hedging effectiveness