File Name: Probability of Default – Merton Market Options Model

Location: Modeling Toolkit | Prob of Default | Merton Market Options Model (Industry Comparable)

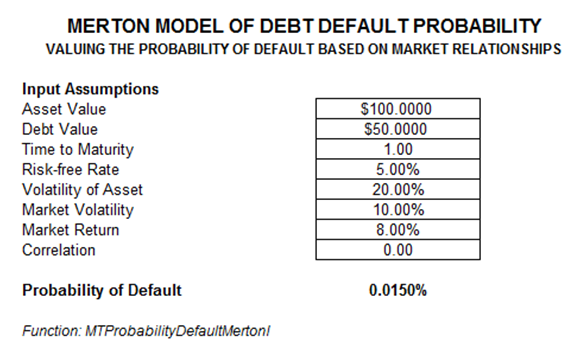

Brief Description: Computes the probability of default and distance to default of a publicly or privately held company by decomposing the firm’s book value of liability, assets, and volatility while benchmarking the company’s returns to some external benchmark or index

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Functions Used: MTMertonDefaultProbabilityI

This models the probability of default for both public and private companies using an index or set of comparables (the market), assuming that the company’s asset and debt book values are known, as well as the asset’s annualized volatility. Based on this volatility and the correlation of the company’s assets to the market, we can determine the probability of default. This model is similar to the models in the last two chapters, which should be reviewed before attempting to run the model illustrated here, as the theoretical constructs of this model are derived from these last two structural models.

Figure 116.1: Merton market options model