File Name: Employee Stock Options – Simple European Call Option

Location: Modeling Toolkit | Real Options Models

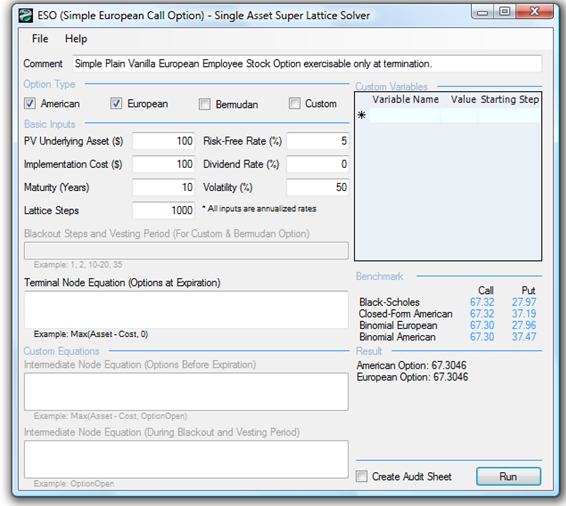

Brief Description: Computes the European call option (the option is exercisable only at maturity) using binomial lattices and closed-form solutions

Requirements: Modeling Toolkit, Real Options SLS

The European call option can be exercised only at maturity. In most typical cases where the underlying asset of stock pays a dividend, an American call option is typically worth more than a Bermudan call option, which in turn is worth more than a European call option, due to each preceding option’s ability to exercise early. Simple European options can be computed using closed-form models (e.g., Black-Scholes; Figure 172.1) as well as binomial lattices. The results are identical when sufficient lattice steps are applied. However, for more complex options models, only binomial lattices are appropriate or can be used to perform the valuation, as will be seen in later chapters.

Figure 172.1: European call option