File Name: Exotic Options – Complex Chooser

Location: Modeling Toolkit | Exotic Options | Complex Chooser

Brief Description: Values the complex chooser option, where the holder has the ability to decide, at a later time, if the option can be a call or a put

Requirements: Modeling Toolkit

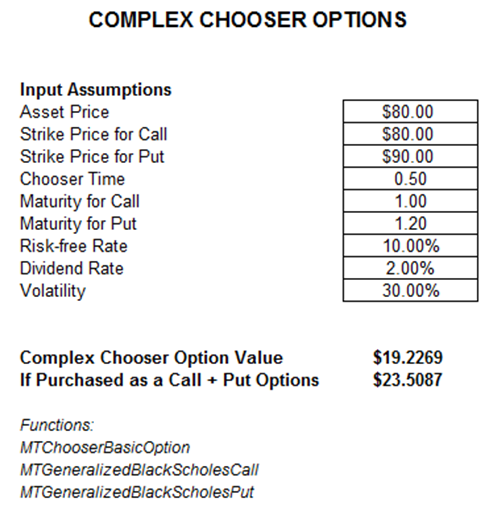

Modeling Toolkit Functions Used: MTChooserComplexOption, MTGeneralizedBlackScholesCall, MTGeneralizedBlackScholesPut

The Complex Chooser Option allows the holder to choose if it becomes a call or a put option by a specific chooser time, while the maturity and strike price of the call and put are allowed to be different. Typically, a chooser option is cheaper than purchasing both a call and a put together. It provides the same level of hedge at a lower cost, while the strike price for both options can be different. Figure 42.1 gives an example of computing the value of a complex chooser option.

Figure 42.1: Computing a complex chooser option