The Liquidity Risk’s Scenario Analysis and Stress Testing settings can be set up to test interest-rate sensitive assets and liabilities. The scenarios to test can be entered as data or percentage changes. Multiple scenarios can be saved for future retrieval and analysis in subsequent tabs as each saved model constitutes a stand-alone scenario to test. Scenario analysis typically tests both fluctuations in assets and liabilities and their impacts on the portfolio’s ALM balance, whereas stress testing typically tests the fluctuations on liabilities (e.g., runs on banks, economic downturns where deposits are stressed to the lower limit) where the stressed limits can be entered as values or percentage change from the base case. Multiple stress tests can be saved for future retrieval and analysis in subsequent tabs as each saved model constitutes a stand-alone stress test.

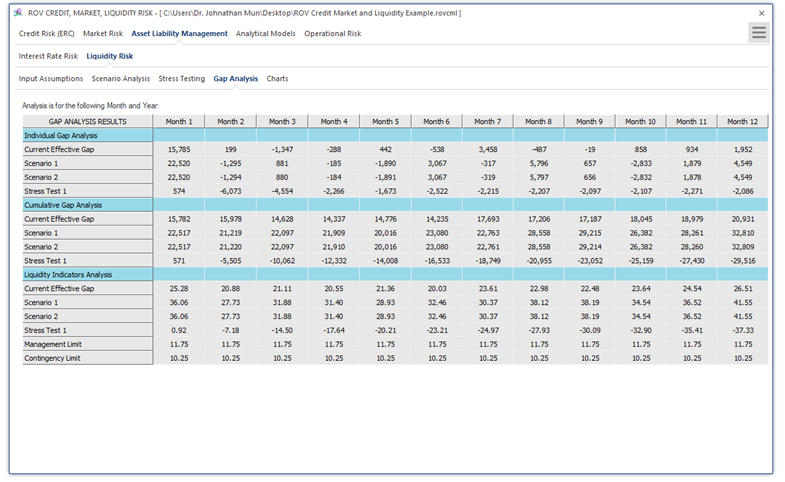

Figure 1.10 illustrates the Liquidity Risk’s Gap Analysis results. The data grid shows the results based on all the previously saved scenarios and stress test conditions. The Gap is, of course, calculated as the difference between Monthly Assets and Liabilities, accounting for any Contingency Credit Lines. The gaps for the multitude of Scenarios and Stress Tests are reruns of the same calculation based on various user inputs on values or percentage changes as described previously in the Scenario Analysis and Stress Testing sections.

Figure 1.10: Asset Liability Management—Liquidity Risk: Gap Analysis