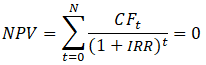

Internal rate of return (IRR) is the discount rate that equates the project’s cost to the sum of the present cash flow of the project. That is, setting NPV = 0 and solving for k in the NPV equation, where k is now called IRR. In other words, where:

Note that there may exist multiple IRRs when the cash flow stream is erratic. Also, the IRR and NPV rankings may be dissimilar. The general rule is that when IRR > required rate of return or hurdle rate or cost of capital, accept the project. That is, if the IRR exceeds the cost of capital required to finance and pay for the project, a surplus remains after paying for the project, which is passed on to the shareholders. The NPV and IRR methods make the same accept/reject decisions for independent projects, but if projects are mutually exclusive, ranking conflicts can arise. If conflicts arise, the NPV method should be used. (The NPV and IRR methods are both superior to the payback, but NPV is superior to IRR.) Conflicts may arise when the cash flow timing (most of the cash flows come in during the early years compared to later years in another project) and amounts (the cost of one project is significantly larger than another) are vastly different from one project to another. Finally, there sometimes can arise multiple IRR solutions in erratic cash flow streams such as large cash outflows occurring during or at the end of a project’s life. In such situations, the NPV provides a more robust and accurate assessment of the project’s value.