File Name: Yield Curve – Curve Interpolation BIM

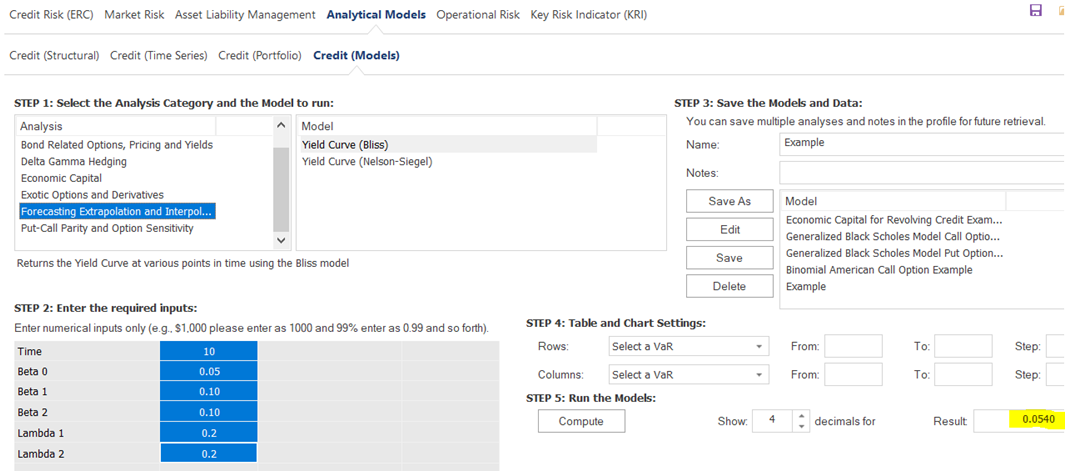

Location: Modeling Toolkit | Yield Curve | Curve Interpolation BIM

Brief Description: This is the BIM model for estimating and modeling the term structure of interest rates and yield curve approximation using curve interpolation methods

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Function Used: MTYieldCurveBIM

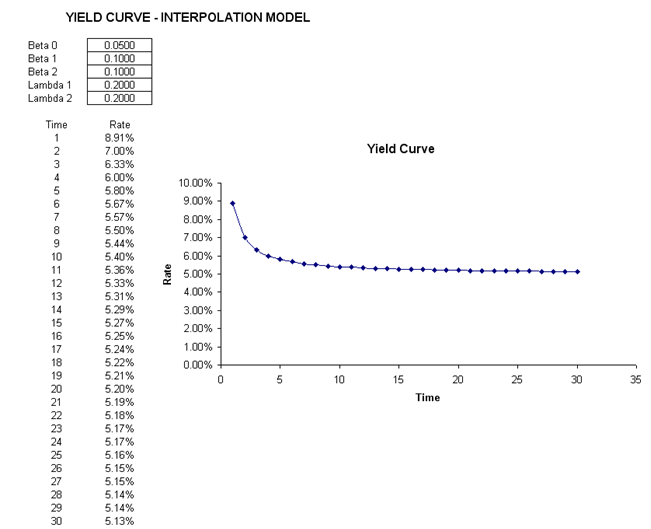

A number of alternative methods exist for estimating the term structure of interest rates and the yield curve. Some are fully specified stochastic term structure models while others are simply interpolation models. The former are models such as the CIR and Vasicek models (illustrated in other sections in this book), while the latter are interpolation models such as the Bliss or Nelson approach. This section looks at the Bliss interpolation model (Figure 2.32) for generating the term structure of interest rates and yield curve estimation. This model requires several input parameters whereby their estimations require some econometric modeling techniques to calibrate their values. The Bliss approach is a modification of the Nelson–Siegel method by adding an additional generalized parameter. Virtually any yield curve shape can be interpolated using these models, which are widely used at banks around the world.

Figure 2.32: BIM Model