File Name: Valuation – Buy versus Lease

Location: Modeling Toolkit | Valuation | Buy versus Lease

Brief Description: Illustrates how to compute the net advantage to leasing by comparing the cash flow differential between purchasing an asset or equipment versus leasing it

Requirements: Modeling Toolkit, Risk Simulator

Leasing versus buying decisions have plagued decision makers ever since a choice was made available. A lease is simply a contractual agreement between a lessee and lessor. This agreement specifies that the lessee has the right to use the asset in return for a periodic payment to the lessor who owns the asset. Typically, the lessor is the equipment or asset manufacturer or a third-party leasing company that purchases the asset from the manufacturer in order to provide a lease to the user. Leases usually are divided into two categories: operating and financial. An operating lease is a lease for a certain period of time that is typically less than the economic life of the asset, which means that the lease is not fully amortized (the total of lease payments received does not cover the cost of the asset). In addition, the lessor or owner of the asset has to cover the maintenance of the asset throughout the life of the lease, and the lease can be terminated early (with an option to abandon) whereby the lessor has the ability to sell the asset at some residual value to recoup the value of the initial asset cost. A financial lease, in contrast, is usually fully amortized and the lease cannot be canceled. In addition, no maintenance is provided for the lessee. In order to entice the lessee into a financial lease, several provisions can be included in the lease. In a sale and leaseback provision, the lessee owns the asset but sells it to the lessor and receives some cash payment upfront, and leases the asset back from the lessor for periodic lease payments. In leveraged leases, a third-party finances the lessor and obtains periodic payments from the lessor, and part of the payments go toward paying off the third-party financing the deal. Other types of leases exist, and exotic instruments and options can be embedded into the contract. For financial reporting purposes, certain leases are classified as capital leases, which will appear on the balance sheet (the present value of future lease payments appear as a liability, with a counterbalance on the asset side for the same amount) whereas operating leases do not appear on the balance sheet and are captured only in the income statement. Therefore, sometimes debt displacement is a hidden cost of leases and should be considered as part of the overall optimal capital allocation in a company.

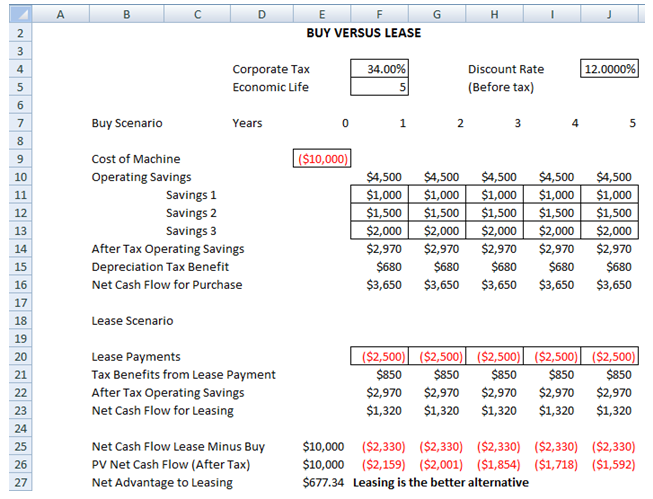

Figure 150.1 illustrates how to compute a purchase versus a lease, specifically looking at the net advantage to leasing. In the first scenario, the asset or equipment is purchased, with the cost of the machine if purchased immediately, and the potential operating savings of having the machine. The corporate tax rate and before-tax discount rate are the required inputs. Using these values, the after-tax operating savings are computed, over the life of the lease, and the tax shield or tax savings from depreciation by owning the equipment (assuming a simple straight-line depreciation, or you may insert your own accelerated depreciation schedule if required), and the net cash flow for purchasing the equipment is computed.

In the lease scenario, the lease payments are listed and the benefits of tax savings from the lease are also included. The after-tax operating savings are added to this tax savings to obtain the net cash flow to leasing. To compute the net advantage to leasing (NAL), the net of the cash flows between the lease and purchase scenarios are computed and discounted back to time zero using an after-tax discount rate. If the NAL is positive, leasing is the better decision. Conversely, if the NAL is negative, purchasing the equipment is the better decision.

In addition, sometimes leases are based on a fluctuation of interest rates that can be uncertain, or the cost of funds can be fluctuating. These inputs can be subjected to simulation, and the resulting NAL is set as the forecast. The probability that NAL is positive can be determined. Hence, this is the same probability that the lease will be more advantageous than the purchase scenario.

Figure 150.1: Buy versus lease scenario cash flows