File Name: Real Options Models – Range Accruals

Location: Modeling Toolkit | Real Options Models | Range Accruals

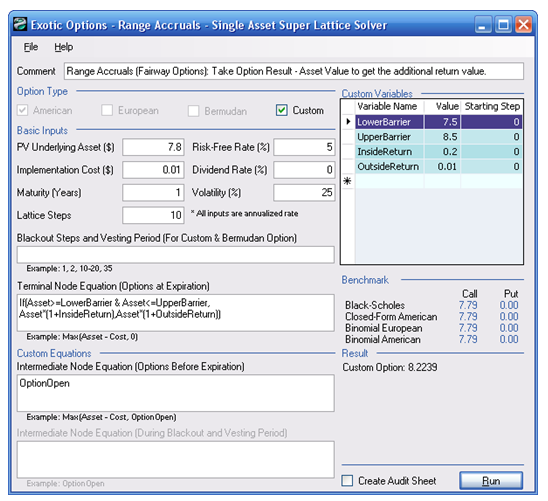

Brief Description: Computes the value of Fairway options or Range Accrual options, where the option pays a specified return if the underlying asset is within a range, but pays something else if it is outside the range, at any time during its maturity

Requirements: Modeling Toolkit and Real Options SLS

A Range Accrual option is also called a Fairway option. Here, the option pays a certain return if the asset value stays within a certain range (between the upper and lower barriers) but pays a different amount or return if the asset value falls outside this range during any time before and up to maturity. The name Fairway option sometimes is used because the option is similar to the game of golf where if the ball stays within the fairway (a narrow path), it is in play, and if it goes outside, a penalty might be imposed (in this case, a lower return). Such options and instruments can be solved using the Real Options SLS software as seen in Figure 69.1, using the Custom Option approach, where we enter the terminal equation as:

If(Asset>=LowerBarrier & Asset<=UpperBarrier,

Asset*(1+InsideReturn), Asset (1+OutsideReturn))

If we wish to solve a European option, we enter the following as the intermediate equation:

OptionOpen

If we are solving an American option, the intermediate equation is:

If(Asset>=LowerBarrier & Asset<=UpperBarrier,

Max(Asset*(1+InsideReturn),OptionOpen), Max(Asset*(1+OutsideReturn), OptionOpen))

Figure 69.1: Range accruals or Fairway options