File Name: Valuation – Break Even Inventory: Seasonal Lending Trial Balance Analysis

Location: Modeling Toolkit | Valuation | Valuation – Break Even Inventory Seasonal Lending Trial Balance Analysis

Brief Description: Illustrates how to value the creditworthiness of a line of credit or debt based on the company’s loan inventory

Requirements: Modeling Toolkit, Risk Simulator

Special Credits: This model was contributed by Prof. Morton Glantz.

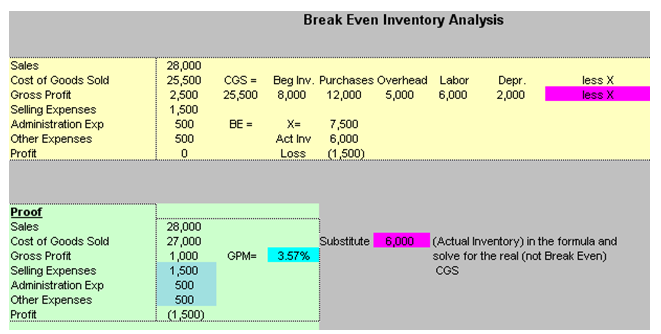

Trial balances take snapshots of general ledger accounts for assets, liabilities, and owner’s equity during any point in the season. Lenders, to detect liquidity problems that compromise repayment, use the break-even inventory method, derived from a trial balance. Liquidity problems stem from inventory devaluations (write-downs). And trouble can surface quickly––two or three months down the season––often on the heels of disappointing bookings. At this point, inventory value usually falls below recorded book value (Figure 152.1).

Trial balances are associated with the periodic inventory method, where inventory is counted and valued at the lower of cost or market periodically, as opposed to the perpetual inventory system, where inventory is counted and valued frequently. Because ending inventory determines the cost of goods sold and ultimately profits, bankers should know inventory value throughout the season. Examples of perpetual inventory include items scanned into the computer a shopper sees at cash registers and high-ticket items painstakingly monitored. Of the two methods, periodic inventory is more uncertain, rendering seasonal analysis indefinable at best if not impossible unless break-even techniques are employed effectively.

Though accountants have not appraised inventory value, assuming periodic inventory, management certainly has. Thus, lenders derive break-even inventory by first asking management for estimated lower cost or market inventory values. They then figure spreads between the two, breakeven and estimated. For example, In Figure 152.1, if inventory required to break even is $7,500 while management estimated inventory is $6,000, net loss for the period is $1,500. Interim losses caused by large inventory write-downs reduce the chances of a short-term loan cleanup. The logic is that write-downs follow production problems, poor strategic planning, stockpiling, canceled orders, overly optimistic sales projections, and flawed cash budgets.

Figure 152.1: Inventory valuation model