File Name: Yield Curve – Forward Rates from Spot Rates

Location: Modeling Toolkit | Yield Curve | Forward Rates from Spot Rates

Brief Description: Determines the implied forward rate given two spot rates

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Function Used: MTForwardRate

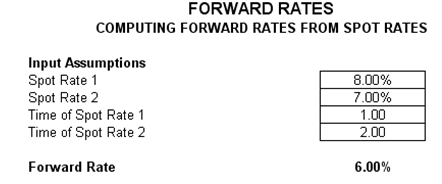

Given two spot rates (from Year 0 to some future time periods), you can determine the implied forward rate between these two time periods using this bootstrap model. For instance, if the spot rate from Year 0 to Year 1 is 8%, and the spot rate from Year 0 to Year 2 is 7% (both yields are known currently), the implied forward rate from Year 1 to Year 2 (that will occur based on current expectations) is 6%. See Figure 166.1.

Figure 166.1: Forward rate extrapolation