The following provides a quick summary of COSO Integrated ERM Framework compliance when using the IRM methodology:

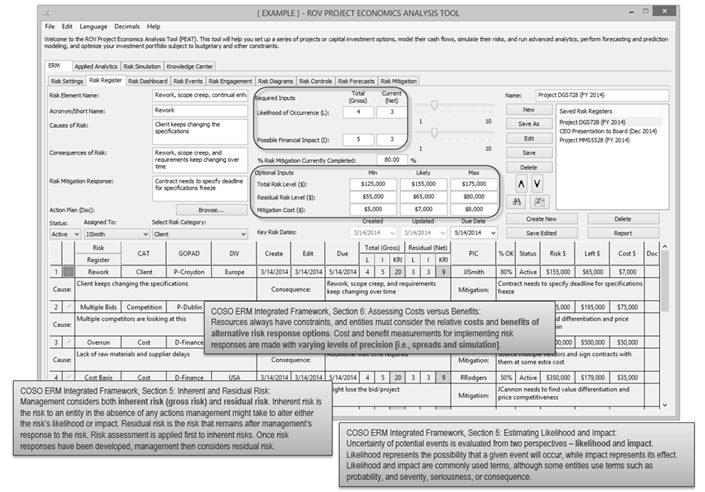

- Figure 3.21 shows the PEAT ERM module’s Risk Register tab where mitigation costs and benefits (gross risks reduced to residual risk levels), likelihood and impact measures, and spreads with varying precision levels ready for Monte Carlo risk simulation are situated, in compliance with COSO ERM Framework Sections 5 & 6.

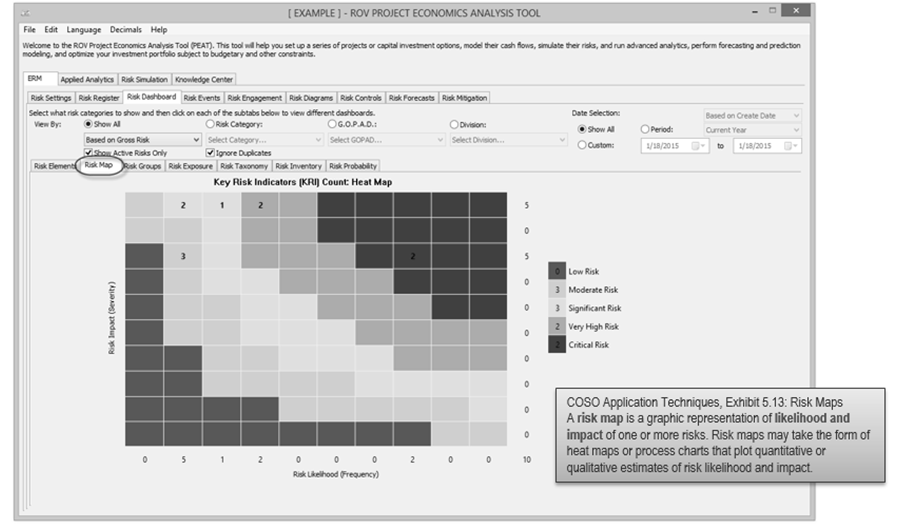

- Figure 3.22 shows the PEAT ERM module where the likelihood and impact within a risk map are generated, in compliance with COSO AT/Exhibit 5.13.

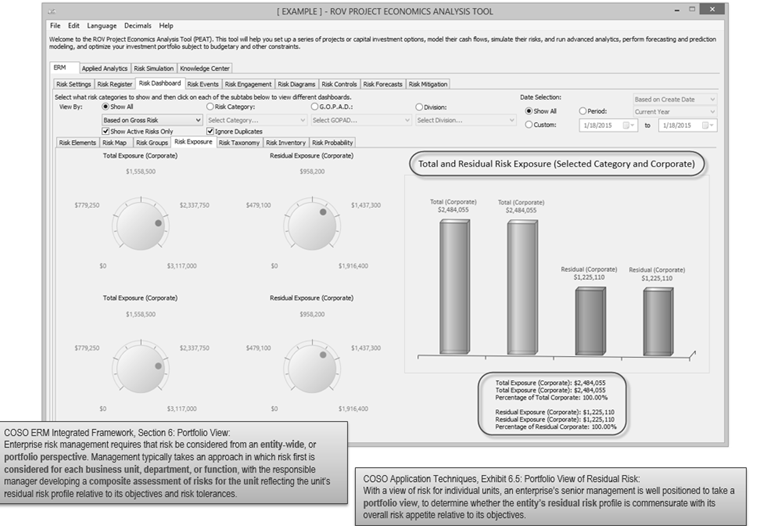

- Figure 3.23 shows compliance with COSO AT/Exhibit 6.5 and COSO ERM Integrated Framework Section 6, where entity-wide portfolio and business unit, department, and functional areas’ gross and residual risks are computed.

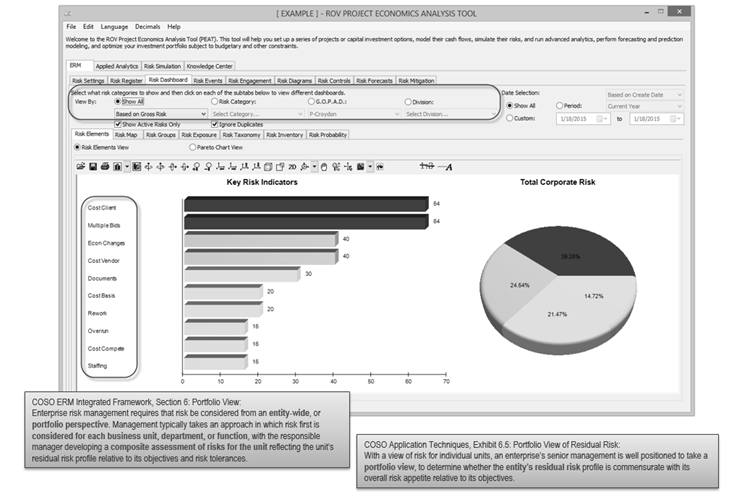

- Figure 3.24, a sample of the Risk Dashboard reports, also shows compliance with COSO AT/Exhibit 6.5 and COSO ERM Integrated Framework Section 6, where entity-wide portfolio and business unit, department, and functional areas’ gross and residual risks are computed and compared against each other.

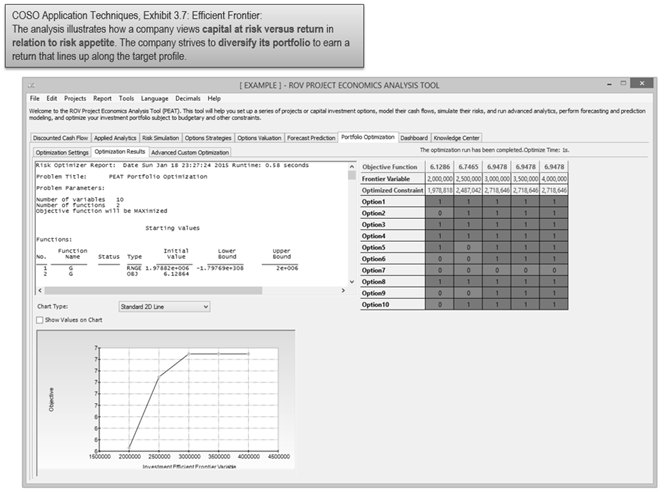

- Figure 3.25 shows the PEAT DCF module’s efficient frontier model, consistent with COSO AT/Exhibit 3.7 requiring an analysis of the capital investment in relation to the returns within a diversified (optimized) portfolio.

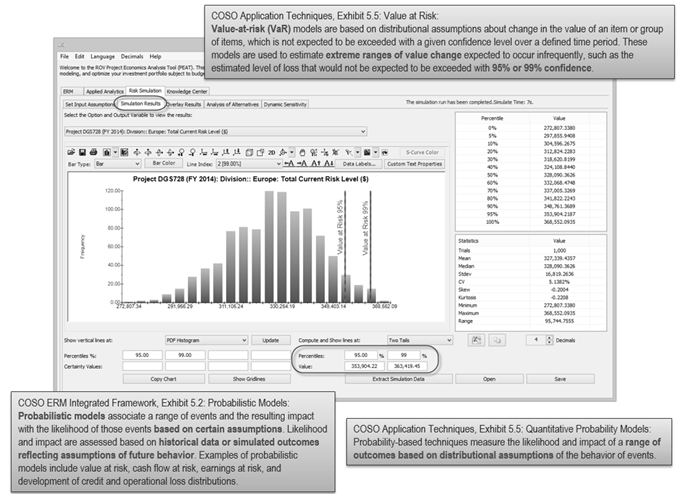

- Figure 3.26 shows the PEAT ERM and DCF module’s simulated results, where Value at Risk, percentiles, and statistical probabilities can be obtained, in compliance with COSO AT/Exhibit 5.5 requiring a range of outcomes based on distributional assumptions, and COSO ERM Integrated Framework Exhibit 5.2 requiring historical or simulated outcomes of future behaviors under probabilistic models.

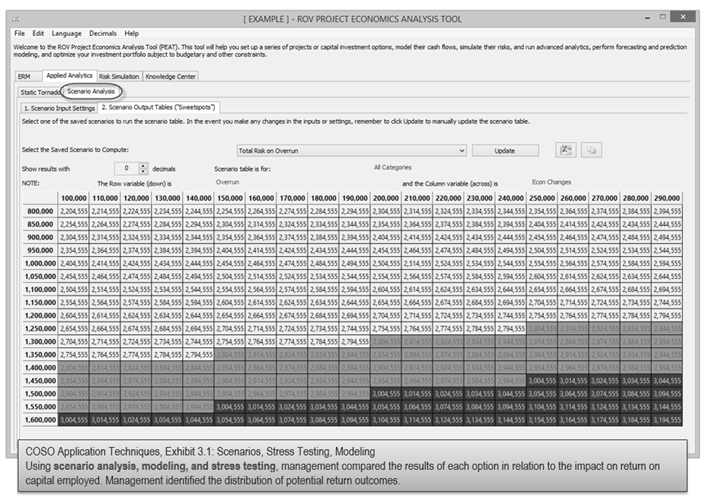

- Figure 3.27 shows compliance with COSO AT/Exhibit 3.1 requiring the use of scenario modeling and stress testing.

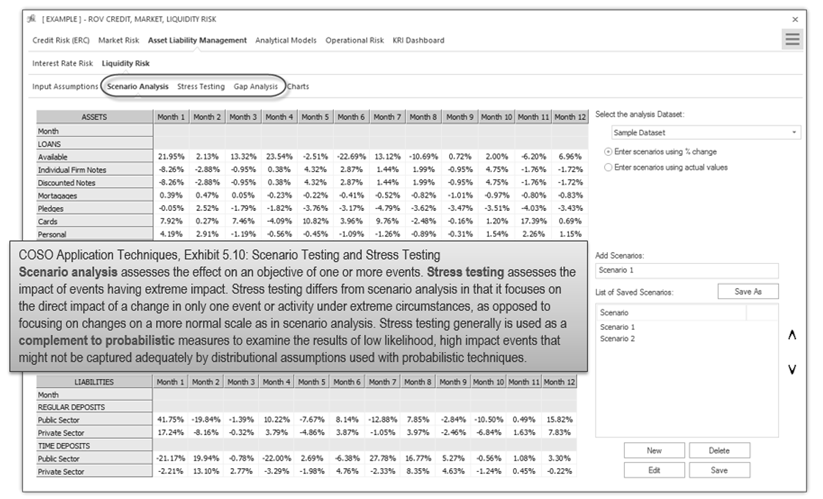

- Figure 3.28 shows the CMOL module in PEAT where scenario analysis, stress testing, and gap analysis are performed, in compliance with COSO AT/Exhibit 5.10, to complement probabilistic models.

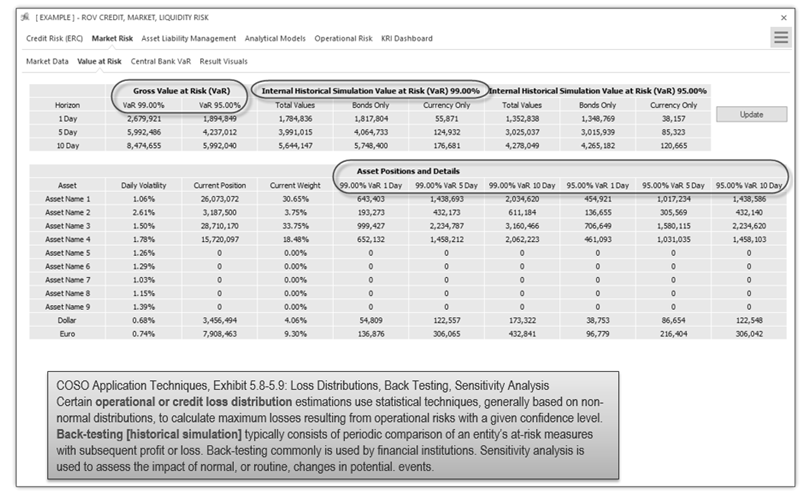

- Figure 3.29 shows compliance with COSO AT/Exhibits 5.8 and 5.9 requiring the modeling of operational and credit loss distributions with back-testing or historical simulation, sensitivity analysis, and Value at Risk calculations.

Figure 3.21: PEAT ERM and COSO Integrated Framework

Figure 3.22: PEAT ERM Heat Map and Risk Matrix

Figure 3.23: PEAT ERM Corporate Portfolio View of Gross and Residual Risk

Figure 3.24: PEAT ERM View by Department, Business Unit, Function, and Portfolio

Figure 3.25: PEAT DCF Module’s Portfolio Optimization and Efficient Frontier

Figure 3.26: PEAT ERM and DCF Module’s Risk Simulation and Value at Risk

Figure 3.27: PEAT ERM and DCF Module’s Scenario Analysis and Heat Map Regions

Figure 3.28: CMOL Module’s Scenario Analysis and Stress Testing

Figure 3.29: CMOL Module’s Value at Risk and Back-Testing Historical Simulations