File Name: Exotic Options – Uneven Dividend Payments

Location: Modeling Toolkit | Exotic Options | Uneven Dividends

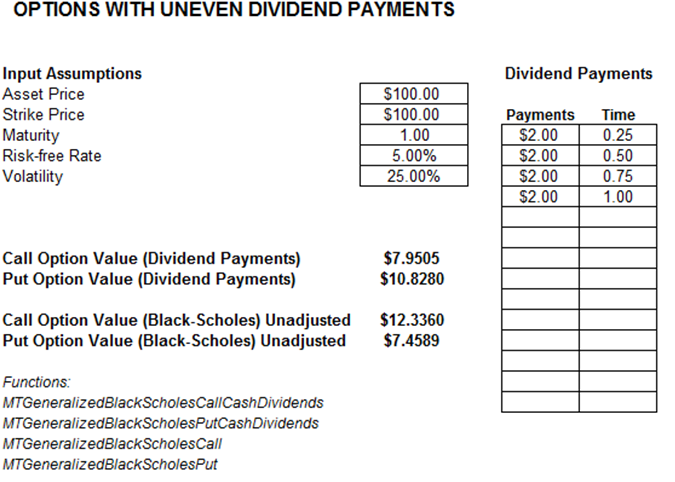

Brief Description: Computes the value of plain vanilla call and put options when the dividend stream of the underlying asset comes in uneven payments over time

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTGeneralizedBlackScholesCallCashDividends, MTGeneralizedBlackScholesPutCashDividends, MTGeneralizedBlackScholesCall, MTGeneralizedBlackScholesPut

Sometimes dividends are paid in various lump sums, and sometimes these values are not consistent throughout the life of the option. Accounting for the average dividend yield and not the uneven cash flows will yield incorrect valuations in the Black-Scholes paradigm. See Figure 78.1.

Figure 78.1: Options with uneven dividend payments