File Name: Exotic Options – Foreign Equity with Fixed Exchange Rates

Location: Modeling Toolkit | Exotic Options | Foreign Equity Fixed Forex

Brief Description: Values foreign equity options where the option is in a currency foreign to that of the underlying asset but with a risk hedging on the exchange rate

Requirements: Modeling Toolkit

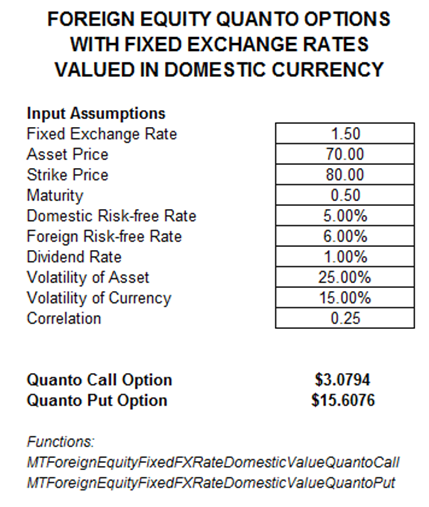

Modeling Toolkit Functions Used: MTForeignEquityFixedFXRateDomesticValueQuantoCall, MTForeignEquityFixedFXRateDomesticValueQuantoPut

Quanto options, also known as Foreign Equity Options, are traded on exchanges around the world. The options are denominated in a currency different from that of the underlying asset. The option has an expanding or contracting coverage of the foreign exchange value of the underlying asset. The valuation of these options depends on the volatilities of the underlying assets and the currency exchange rate, as well as the correlation between the currency and the asset value (Figure 51.1).

Figure 51.1: Foreign equity with fixed forex in domestic currency