File Name: Exotic Options – American, Bermudan, and European Options with Sensitivities

Location: Modeling Toolkit | Exotic Options | American, Bermudan, and European Options

Brief Description: Computes American, Bermudan, and European options with Greek sensitivities

Requirements: Modeling Toolkit

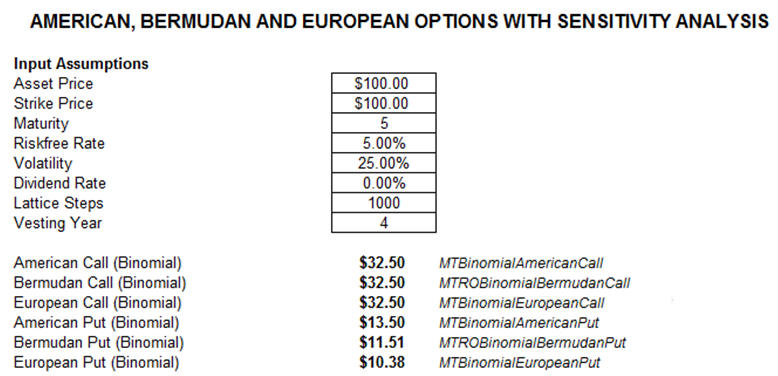

Modeling Toolkit Functions Used: MTBinomialAmericanCall, MTBinomialBermudanCall, MTBinomialEuropeanCall, MTBinomialAmericanPut, MTBinomialBermudanPut, MTBinomialEuropeanPut, MTGeneralizedBlackScholesCall, MTBinomialAmericanPut, MTGeneralizedBlackScholesPut, MTClosedFormAmericanCall, MTClosedFormAmericanPut, MTCallDelta, MTCallGamma, MTCallTheta, MTCallRho, MTPutVega MTPutDelta, MTPutGamma, MTPutTheta, MTPutRho, MTPutVega

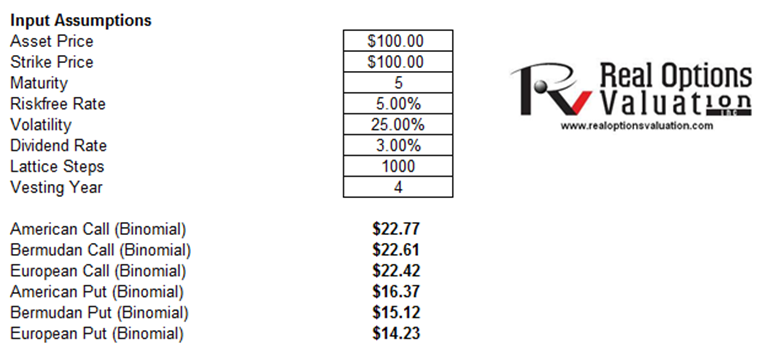

American options can be exercised at any time up to and including maturity, European options can only be exercised at maturity, and Bermudan options can be exercised at certain times (exercisable other than during the vesting blackout period). In most cases, American ≥ Bermudan ≥ European options except for one special case: for plain vanilla call options when there are no dividends, American = Bermudan = European call options, as it is never optimal to exercise early in a plain vanilla call option when there are no dividends (Figure 31.1). However, once there is a sufficiently high dividend rate paid by the underlying stock, we clearly see that the relationship where American ≥ Bermudan ≥ European options apply (Figure 31.2).

European options can be solved using the Generalized Black-Scholes-Merton model (a closed-form equation) as well as using binomial lattices and other numerical methods. However, for American options, we cannot use the Black-Scholes model and must revert to using the binomial lattice approach and some closed-form approximation models. Using the binomial lattice requires an additional input variable: lattice steps. The higher the number of lattice steps, the higher the precision of the results. Typically, 100 to 1,000 steps are sufficient to achieve convergence. Use the Real Options SLS software to solve more advanced options vehicles with a fully customizable lattice model. Only binomial lattices can be used to solve Bermudan options. The Real Options SLS software is used to solve more advanced and exotic options vehicles with a fully customizable lattice model in later chapters.

Figure 31.1: American, Bermudan, and European options with Greeks

Figure 31.2: American, Bermudan, and European options with Dividends