File Name: Exotic Options – Forward Start

Location: Modeling Toolkit | Exotic Options | Forward Start

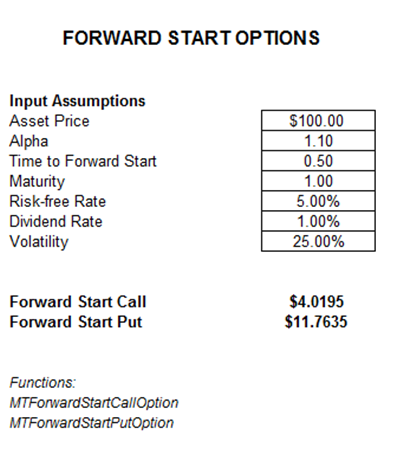

Brief Description: Computes the value of an option that technically starts in the future, and its strike price is a percentage of the asset price in the future when the option starts

Requirements: Modeling Toolkit

Modeling Toolkit Functions Used: MTForwardStartCallOption, MTForwardStartPutOption

Forward Start Options start at the money or proportionally in or out of the money after some time in the future (the time to forward start). These options sometimes are used in employee stock options, where a grant is provided now but the strike price depends on the asset or stock price at some time in the future and is proportional to the stock price. The Alpha variable measures the proportionality of the option being in or out of the money. Alpha = 1 means the option starts at the money or that the strike is set exactly as the asset price at the end of the time to forward start. Alpha < 1 means that the call option starts (1 – Alpha) percent in the money, or (1 – Alpha) out of the money for puts. Conversely, for Alpha > 1, the call option starts (Alpha – 1) out of the money and puts start (Alpha – 1) in the money. Figure 53.1 shows an example of valuing Forward Start options.

Figure 53.1: Forward start options