File Name: Yield Curve – Curve Interpolation NS

Location: Modeling Toolkit | Yield Curve | Curve Interpolation NS

Brief Description: Estimates and models the term structure of interest rates and yield curve approximation using a curve interpolation method

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Function Used: MTYieldCurveNS

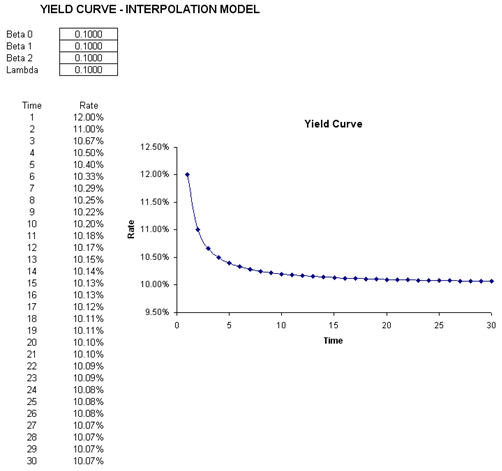

This is the Nelson-Siegel (NS) Interpolation model for generating the term structure of interest rates and yield curve estimation. Some econometric modeling techniques are required to calibrate the values of several input parameters in this model. Just like the Bliss model in the previous chapter, the NS model (Figure 165.1) is purely an interpolation model, with four estimated parameters. If properly modeled, it can be made to fit almost any yield curve shape. Calibrating the inputs in the NS model requires facility with econometric modeling and error optimization techniques. Typically, if some interest rates exist, a better approach is to use the spline interpolation method (see Chapter 168 for details).

Figure 165.1: NS model