File Name: Employee Stock Options – Vesting, Blackout, Suboptimal, Forfeiture

Location: Modeling Toolkit | Real Options

Brief Description: Computes an employee stock option after considering the real-life elements of vesting, blackout periods, suboptimal exercise behaviors, and forfeiture rates, which usually significantly lower the value of the option to be expensed and are solved only using a customized Real Options SLS approach (closed-form models are inadequate and inappropriate)

Requirements: Modeling Toolkit, Real Options SLS

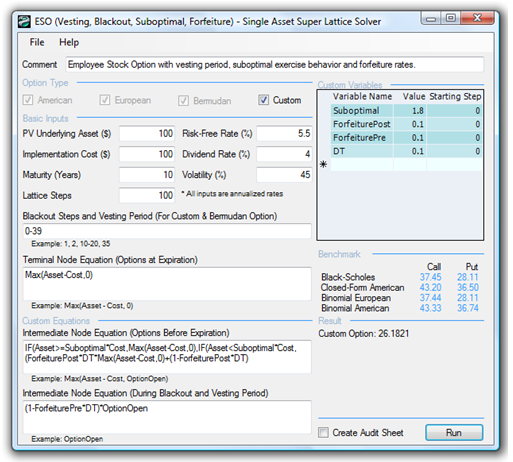

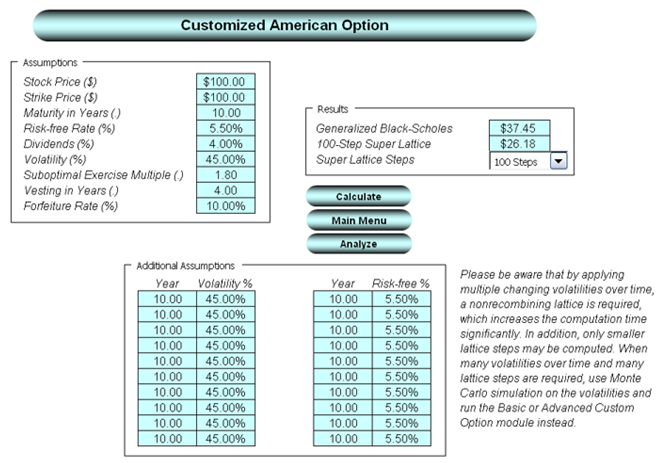

This model incorporates the element of forfeiture into the model as seen in Figure 174.1 (example file used: ESO Vesting, Blackout, Suboptimal, Forfeiture). This means that if the option is vested and the prevailing stock price exceeds the suboptimal threshold above the strike price, the option will be executed summarily and suboptimally. If vested but not exceeding the threshold, the option will be executed only if the postvesting forfeiture occurs; otherwise the option is kept open. This means that the intermediate step is a probability-weighted average of these occurrences. Finally, when an employee forfeits the option during the vesting period, all options are forfeited, with a prevesting forfeiture rate. In this example, we assume identical pre- and postvesting forfeitures so that we can verify the results using the ESO Toolkit (Figure 174.2). In certain other cases, a different rate may be assumed. The next chapter applies these methodologies to solve actual business cases, where the process of options framing can be seen.

Figure 174.1: SLS results of a call option accounting for vesting, forfeiture, suboptimal behavior, and blackout periods

Figure 174.2: ESO Toolkit results after accounting for vesting, forfeiture, suboptimal behavior, and blackout periods