File Name: Probability of Default – Merton Internal Model

Location: Modeling Toolkit | Prob of Default | Merton Internal Model (Private Company)

Brief Description: Computes the probability of default and distance to default of a privately held company by decomposing the firm’s book value of liability, assets, and volatility

Requirements: Modeling Toolkit, Risk Simulator

Modeling Toolkit Functions Used: MTMertonDefaultProbabilityII, MTMertonDefaultDistance

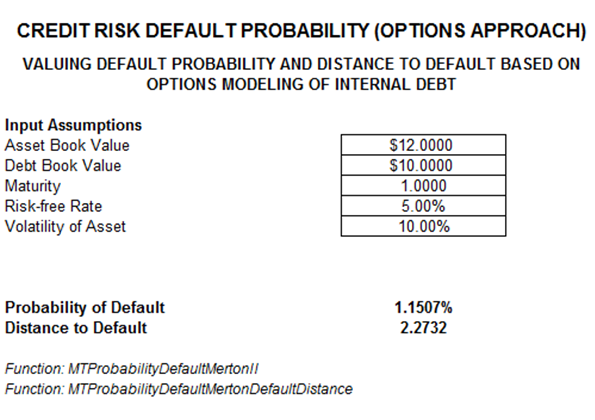

This model is a structural model that employs the options approach to computing the probability of default and distance to default of a company assuming that the book values of asset and debt are known, as are the asset volatilities and anticipated annual growth rates. If the book value of assets or volatility of assets is not known and the company is publicly traded, use the External Options model in the previous chapter instead. This model assumes these inputs are known or the company is privately held and not traded. It essentially computes the probability of default or the point of default for the company when its liabilities exceed its assets, given the asset’s growth rates and volatility over time (Figure 115.1). It is recommended that the reader review the previous chapter’s model on an external publicly-traded company before using this model. Methodological parallels exist between these two models, with this chapter building on the knowledge and expertise of the last one.

Figure 115.1: Credit default risk model with options modeling